At year’s end, advisors often receive questions about how to maximize and finalize retirement contributions. Below is a straightforward guide to help navigate year-end contributions, along with key rules to keep in mind.

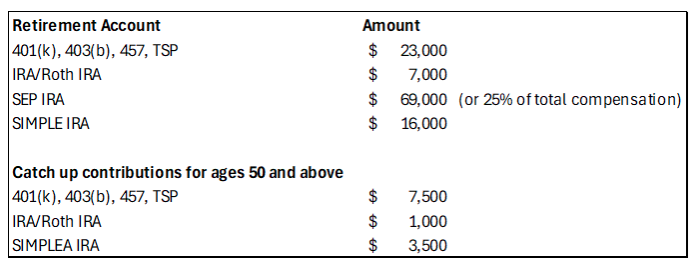

Maximizing Contributions: The primary goal of year-end contributions is to maximize the amount contributed to retirement plans, such as 401(k)s, IRAs, or similar vehicles. For 2024, here are the max contributions:

Source: www.irs.gov

As a note, for those looking to max out their employer-sponsored retirement plans (401(k)/403(b)), you CANNOT contribute outside funds to the retirement plan. You are limited to the funds paid to you through payroll. Depending on your Year to Date (YTD) contributions, you may need to slightly adjust your last month’s contributions to ensure you are putting in the maximum contribution. If you are unsure where your contributions stand YTD, your HR department should be able to assist.

Prioritizing Contributions: If you are covered under an employer plan (401(k), 403(b), etc…), you should seek to max out contributions to this account first as there is typically a company match provided. Any additional savings above and beyond this can be made to a non-retirement account, or an IRA (subject to income limits).

Contribution Deadlines: While most retirement accounts share tax treatment, they do not all share contribution deadlines. Employer plans have a deadline of Dec. 31st for current-year contributions while IRAs/Roth IRAs/SEP IRAs can backdate contributions until next year’s tax filing. As a note, since there are calculations associated with SEP IRA contributions, the contribution deadline can be extended if the official filing is extended.

If you have any questions regarding your personal or retirement accounts, contact your CCP advisor.

John E. Chapman

Chief Executive Officer

John E. Chapman

Chief Executive Officer