Whenever we creep toward the end of another calendar year, there are always year-end planning ideas to consider for investors.

With the passing of the One Big Beautiful Bill Act (OBBBA) back in July, in conjunction with a rising stock market environment this year, 2025 is no exception. For those who are charitably inclined, right now might be a particularly good time to consider funding a charitable account such as a donor-advised fund (DAF).

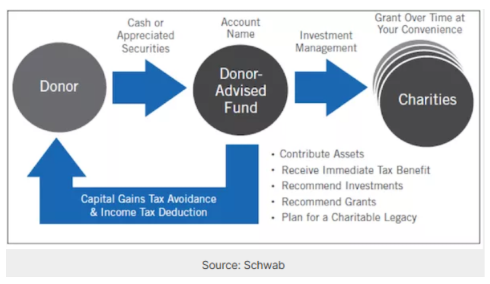

A DAF is a charitable giving vehicle that allows individuals to contribute cash or assets, receive an immediate income tax deduction, and then recommend grants over time to qualified charities of his or her choice.

Why could this be the right time to fund a DAF?

With rising stock markets in 2025, does funding a DAF make sense?

With the appreciation in stocks and many other asset classes in 2025, many investors have accumulated significant unrealized capital gains on some of their investment holdings. By contributing appreciated assets from a taxable investment account, such as a revocable trust, into a charitable entity like a donor-advised fund, an individual can receive significant income tax benefits including:

Ability to avoid capital gains tax on the appreciated asset:

- If appreciated stock or other assets are sold, capital gains taxes would be due based on the amount of profit realized.

- By donating the appreciated assets directly into a DAF, the donor can bypass the capital gains tax. This also preserves more of the asset’s value for your charitable giving goals.

Receive an immediate tax deduction:

- When you donate appreciated assets that you have held for more than a year to a public charity (including a DAF), you can deduct the asset’s full Fair Market Value, subject to a 30% Adjusted Gross Income (AGI) limit.

Does the passing of the OBBBA make 2025 an ideal year to consider a DAF?

- Starting in 2026, less favorable charitable giving rules will take effect which creates a narrow window for many donors to maximize their income tax deduction by making charitable contributions in 2025.

For High-Income Earners

High-income earners in the top 37% marginal income tax bracket stand to gain the most by acting in 2025 before new limitations kick in.

- Higher deduction value: In 2025, donors in the top 37% bracket can claim a deduction that is worth 37 cents for every dollar they contribute to charity. Starting in 2026, the tax benefit for those in the highest bracket will be capped at 35%.

- Avoid the new AGI floor: The OBBBA imposes a new floor for charitable deductions starting in 2026 on individuals who itemize their income tax deductions. Only contributions that exceed 0.5% of a taxpayer’s Adjusted Gross Income (AGI) will be deductible. For example, a couple with a $300,000 AGI must donate over $1,500 before they can claim any charitable deduction. A large contribution into a DAF in 2025 allows donors to avoid this future floor (www.ncfgiving.com).

For Strategic Tax Planning

For many taxpayers, 2025 is an ideal year to consider a DAF for a “bunching” strategy.

- Maximize deductions with bunching: With the higher standard deduction amount made permanent by the OBBBA, the trend of fewer people itemizing their deductions is likely to continue in the future. By looking ahead and “bunching” several years’ worth of charitable gifts into a large single DAF contribution, donors might be able to exceed the standard deduction enabling them to itemize in 2025 (and subsequently reducing their income tax liability).

In subsequent years, they can return to using the standard deduction when filing their income tax return and make grants out of the DAF to their favorite charities. The strategy of bunching one’s giving can be especially effective in a high-income year and the individual expects to be in a lower income tax bracket in future years, which is common when entering the retirement stage.

- Contribute a concentrated investment to further diversify your portfolio: Donating appreciated stock and non-cash assets into a DAF in 2025 can be particularly valuable for investors with concentrated asset positions. This provides investors with the potential to not only reduce exposure to the investment(s) in a tax-efficient manner, but also simultaneously improve overall investment portfolio diversification.

Some Other Key Considerations

- Your itemizing status: Donating appreciated assets to a DAF is most beneficial if you itemize your deductions, which allows you to take greater advantage of the charitable deduction rules.

- Streamlined giving: Using a DAF simplifies record-keeping by consolidating many individual donations into one tax receipt from the DAF sponsor.

- Ability to fund with a broad range of assets: While appreciated stock is the most common non-cash asset for DAF contributions, you can also contribute more complex assets like real estate or private business interests. Please note that some DAF sponsors have more experience handling these types of assets than individual charities.

- Donating cash versus stock: As previously noted, donating appreciated stock is typically more tax-efficient than selling the stock and subsequently donating the cash proceeds. In addition to the deduction, you eliminate the capital gains tax you would have paid on the sale.

- Estate & Legacy Planning: DAFs offer a structured way to leave a lasting charitable legacy, allowing you to name successor advisors or designate charities who you earmark to receive funds after your death.

- Family Philanthropy: DAFs can be a simple way to involve children and future generations in charitable giving, teaching them about supporting community needs and your family values.

How to set up a Donor-Advised Fund and how does it work?

- Open a DAF fund account: Open an account with a sponsoring organization. Some of the largest DAF sponsors include Schwab Charitable, Fidelity Charitable, and the National Christian Foundation. This process can typically be done efficiently online.

- Make a contribution into the account: Make a donation of cash, securities, or other assets into the account. The donor receives an immediate income tax deduction for the fair market value (FMV) of the contribution on the day of the gift.

- Invest and grow: The assets in the DAF can be invested to grow over time, and the investment growth within the account is tax-free.

- Recommend grants: The account owner recommends grants from the fund be directed to any number of qualified public charities. The sponsoring organization must approve the grant and if approved, they will send the requested donation amount to the selected charity.

- Maintain flexibility: The account owner can decide how much and when to make a grant, making it a very flexible way to manage charitable giving. The donor can also choose to receive recognition for the donation or remain completely anonymous.

Donor-Advised Fund Example*

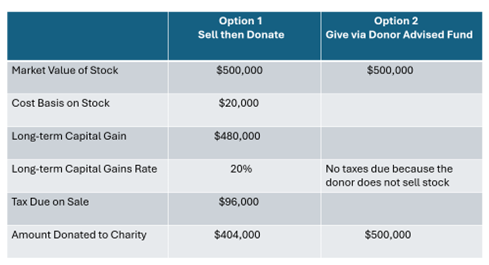

Recently, as part of a client couple’s overall wealth plan, our Clearwater team assisted with the opening and funding of a donor-advised fund. The DAF was funded with very low-cost appreciated stock that he and his wife had owned for over 20 years. The value of the contributed stock on the day of the gift into the DAF was $500,000 and the original cost on those gifted shares was approximately $20,000.

As illustrated below, rather than selling the stock and gifting cash into the DAF, which would realize a capital gain of $480,000 and be subject to both a 20% capital gains rate (and perhaps also a 3.8% investment income tax rate), the gifted stock instead will produce a $500,000 charitable income tax deduction with no capital gains taxes due from this transaction on their 2025 Federal Income Tax return.

This example illustrates not only the positive tax impact of funding the DAF, but also the greater financial impact to the charitable organizations who will benefit from receiving grants from the DAF in the future (i.e. an additional $96,000 will eventually go to charities instead of the IRS!).

Please also note that if a taxpayer is unable to use the entire value of the charitable contribution as a tax deduction in the year of the gift due to the AGI limit noted above, they are allowed to carry forward the unused charitable contribution amount for up to 5 subsequent tax years.

Summary

Depending on the situation, an individual can effectively leverage a donor-advised fund in order to take advantage of immediate tax benefits, while also looking to maximize charitable impact for years to come. Favorable markets this year along with the passage of the One Big Beautiful Bill Act strengthens the case for opening (and funding) a DAF by December 31st, 2025, especially for individuals with higher incomes and large philanthropic ambitions.

The Advanced Planning and Advisory team at Clearwater Capital Partners provides guidance and comprehensive financial planning. In conjunction with one’s personal tax advisor, they can also address specific tax-related questions such as whether a charitable planning strategy including a donor-advised fund might make sense.

*The Donor-Advised Fund example is an actual client case to be used for illustrative/educational purposes only. Please consult qualified professionals with any tax planning needs or tax questions you may have. You may also visit www.irs.gov for more tax related information.

20251103 – 2

John E. Chapman

Chief Executive Officer

John E. Chapman

Chief Executive Officer