As I wrote in a 2023 post, the potential impact of future taxes is often an important consideration for retirees when choosing to move to another state. Besides moving to an area with a warmer climate or closer to family and friends, the goal of minimizing expenses, including taxes, is often at the top of the priority list.

The question is often asked, “Can I actually save money by moving to a different state?”, and the answer is “it depends.” It is based not only on where someone moves to, but also on how they live their life.

Prior to making the decision to relocate, it is important to compare the different taxes. This might include reviewing:

- Projected state and local income taxes

- Property taxes

- Sales taxes that would impact you

- Additional considerations i.e., such as the level of state estate and inheritance taxes

As we will explore here, the tax rules differ from state to state, sometimes by significant amounts. Because a tax burden often comprises a significant part of the overall cost of living, understanding the major tax impacts from one state to another is important prior to making a relocation decision out-of-state.

Income Taxes

If the intent is to relocate to a lower tax state, the first thought might be to move to a state that has no personal income tax. While understandable, if the individual is no longer working, simply moving to a state with a low income tax rate might not be a priority compared to the other forms of taxes that will come into play. For retirees, whether a state taxes different forms of retirement plan income might be of greatest importance, for example.

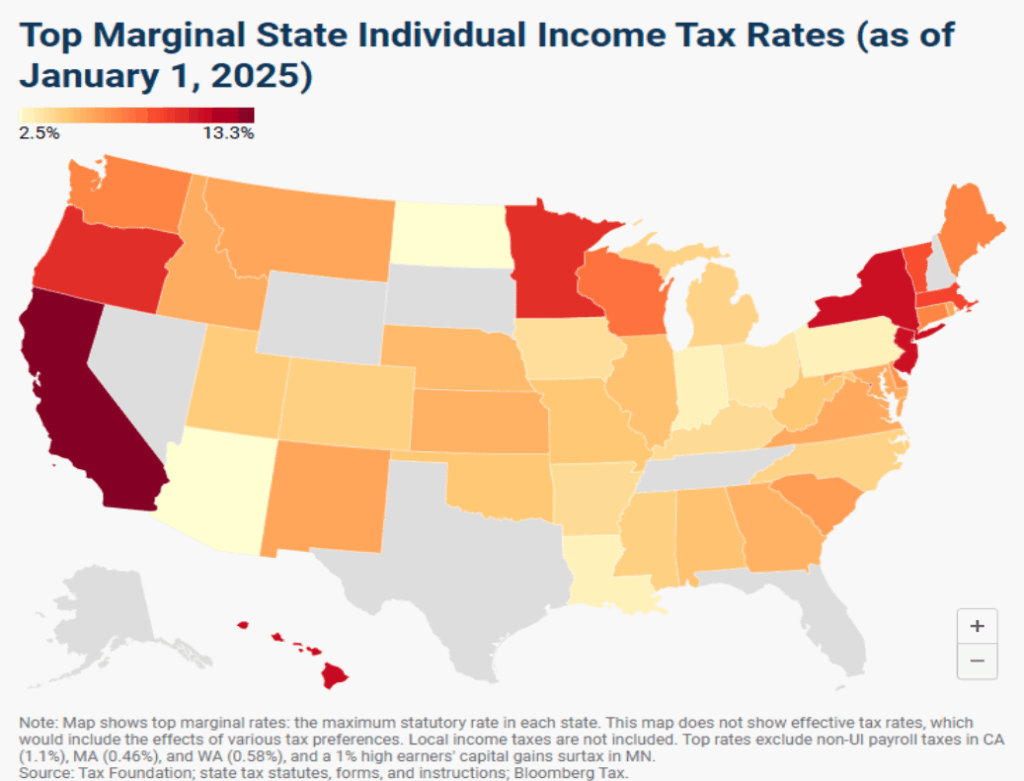

Currently, the state with the highest state income tax as a percentage of income is California, followed by Hawaii, New York, New Jersey, and Oregon (Source: Tax Foundation, 2025).

It is important to remember that these are the states with the highest marginal income tax brackets, but not necessarily the highest effective tax rate. California, for example, while having the highest marginal tax rate, will have an effective tax rate of 3.7% for a couple with taxable income of $120,000.

There are now nine states that do not have an income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. There are also four states that have a state income tax, but do not tax retirement income: Illinois, Iowa, Mississippi, and Pennsylvania.

For Illinois residents, for example, withdrawals from retirement accounts, public and private pension income, and social security payments are all classified as non-taxable income. This feature, along with the fact that Illinois currently assesses a flat income tax rate at a comparatively low 4.95%, helps to place Illinois very favorably from an income tax standpoint when compared to other states.

Importantly, many states have made significant changes to their state income tax laws over the past few years, and there is an expectation that more changes are coming.

Iowa is a prime example of this, where their legislature voted to cut the top state income tax rate from an 8.53% highest marginal tax rate in 2022 to a flat 3.8% applied to all taxable income in 2025 (revenue.iowa.gov-2025).

The following color-coded map illustrates the level of income taxes by state at the start of 2025.

Property Taxes

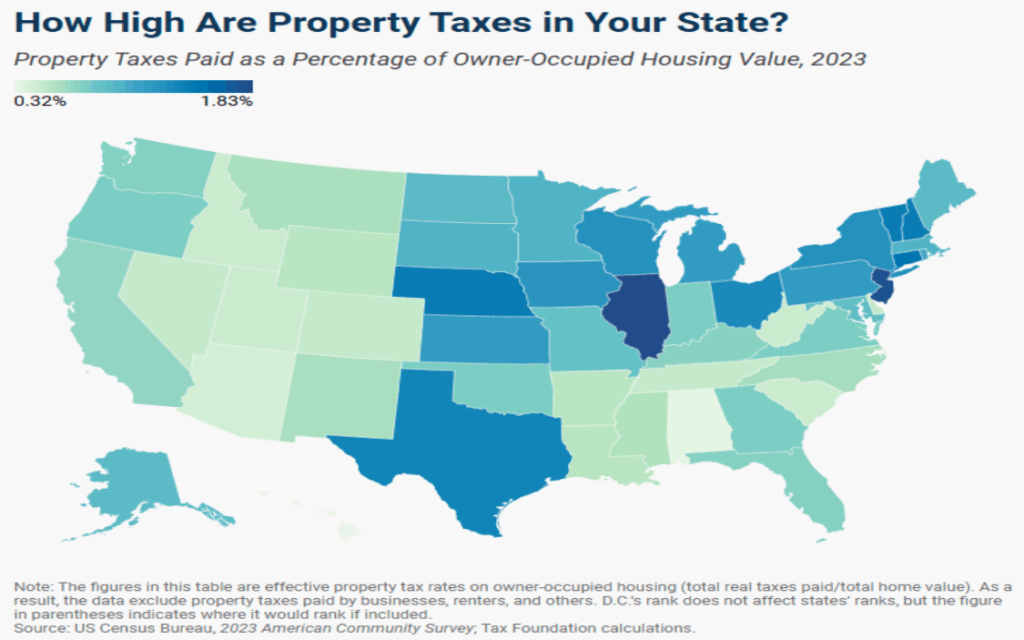

Similar to state income taxes, the amount Americans pay in annual property taxes can vary by thousands of dollars depending on where they reside.

For example, in New Jersey, residents had the highest effective owner-occupied property tax rate at 2.23%, followed by Illinois (2.07%), Connecticut (1.92%), New Hampshire (1.77%), and Vermont (1.71%) (Tax Foundation, 2025). Overall, the Northeast and Midwest dominate the list of states with the highest property tax rates.

On the opposite end of the spectrum, the lowest median property tax bill is in Hawaii (0.31%, annually) followed by Arizona (0.41%), Alabama (0.42%), Delaware (0.43%), and Tennessee (0.44%) (Taxfoundation.org).

Please note that even in states with low median property taxes (shaded in light green above), it is possible that there are relatively high local property taxes within those states.

Also, with the recently passed One Big Beautiful Bill Act (OBBBA), which increased the cap for the State and Local Tax deduction (SALT), it is now possible that many residents living in a state with high property taxes could have a reduced overall tax burden in the future.

The OBBBA caps the allowable state and local tax deduction, which includes property taxes, at $40,000 (for individuals and married couples, filing jointly). This $40,000 deduction cap begins to phase out at Modified Adjusted Gross Income (MAGI) levels above $500,000. For those with MAGI above $600,000, the SALT deduction is capped at $10,000 (as in the previous tax legislation).

With this recent increase in the SALT deduction, more taxpayers may be able to deduct a significantly higher amount of property taxes paid against income when filing future Federal Income Tax returns.

Sales Taxes: State and Local

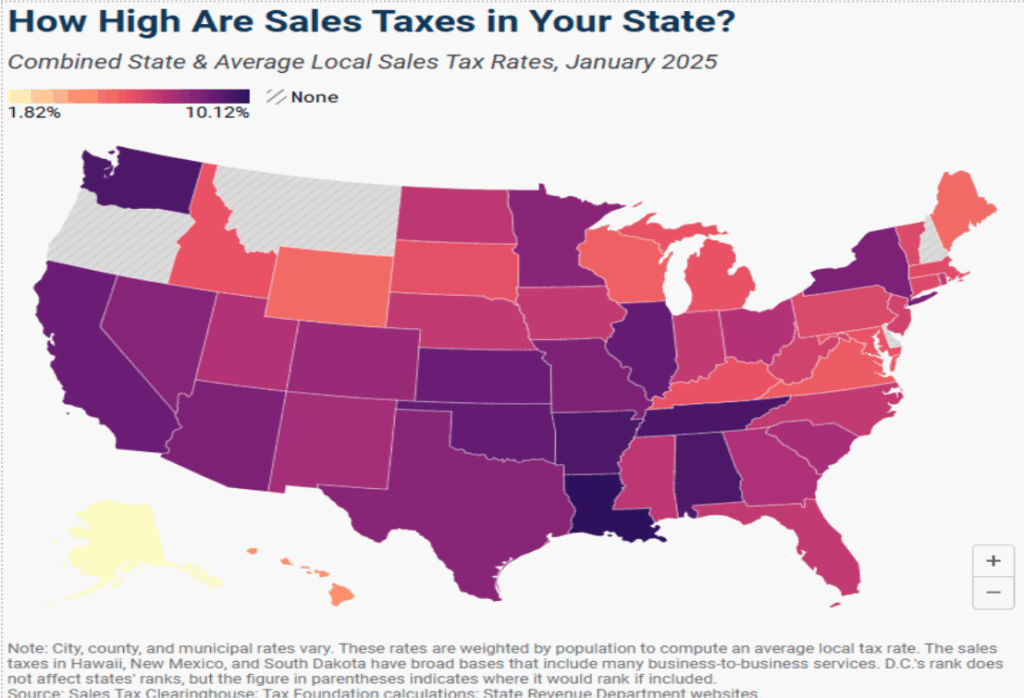

Currently, there are 45 states that collect statewide sales taxes and 38 states that collect local sales taxes. There are currently five states that forego statewide sales taxes: Alaska, Delaware, Montana, New Hampshire, and Oregon. Keep in mind that these 5 states do allow their local jurisdictions to levy a sales tax or other forms of taxes such as excise taxes or resort fees.

The five states with the highest average combined state and local sales tax rates are: Louisiana (10.12%), Tennessee (9.56%), Arkansas (9.46%), Washington (9.43%), and Alabama (9.43%).

It is interesting to note that Tennessee, the state with the second highest average sales taxes in the United States, is also one of the lowest property tax states and among the few states that assess no income tax. Oregon, on the other hand, has no sales tax but is a relatively high-income tax state.

Other states with low comparative taxes in one category may implement other high taxes on necessities, such as gasoline, or charge more for state services, such as driver’s licenses or car registrations. For residents, those hidden costs can have a tangible impact on the personal budget.

This illustrates that state governments will generate tax revenue in various ways to cover their expenses, and it is important to know the potential impact of a state’s tax structure on you.

Combined Overall Taxes: Highest and Lowest States

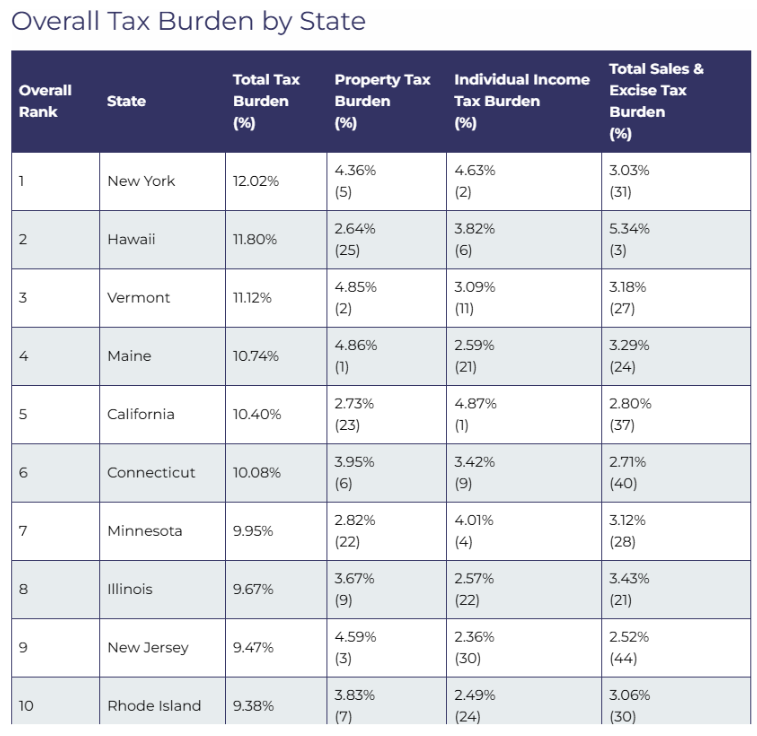

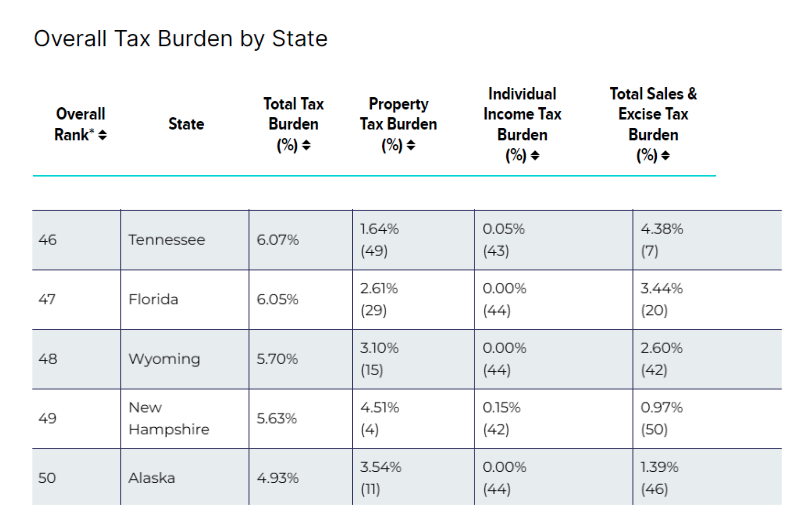

When viewing the level of taxes in aggregate (property, income, and sales, and excise taxes) as a percentage of personal income, New York currently has the highest overall tax burden on its residents, while Alaska ranks as the state with the lowest taxes (Source: Taxfoundation.org; January 2025).

Please see the next page for a truncated version of the states with the highest and lowest taxes.

WalletHub; January 2025

Death and Inheritance Taxes

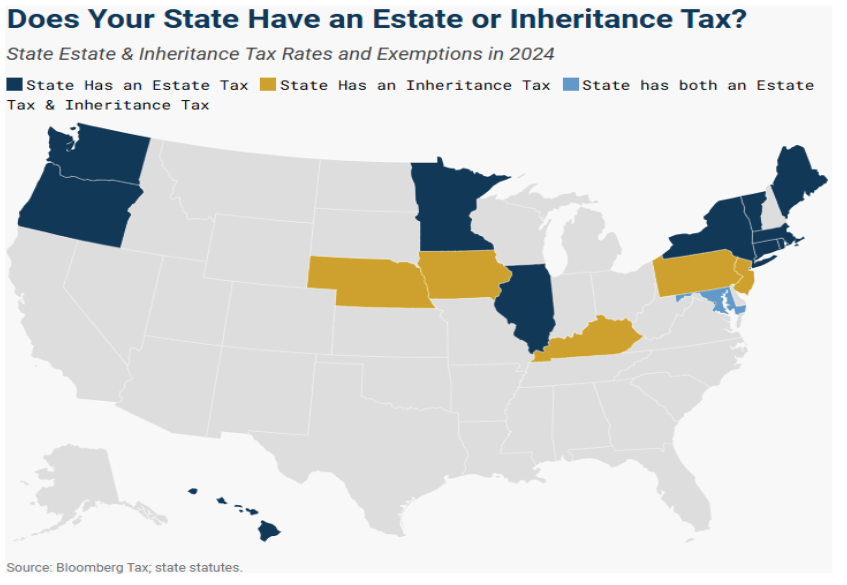

Besides the impact from state income, property, and sales taxes, often overlooked when relocating from one state to another from a tax impact standpoint, are death and inheritance taxes. For those concerned about the impact on their beneficiaries in the future, comparing estate or inheritance tax rules in your current and future home states is important before moving.

Most states don’t impose death taxes, but in those that do, state taxes may kick in well before federal estate taxes. Currently, 32 states do not levy a state estate or inheritance tax, 12 states (and the District of Columbia) impose a state estate tax, and six states levy an inheritance tax. Maryland is the only state that imposes both an estate and an inheritance tax.

In some instances, the level of state estate taxes could be a determining factor in whether an individual decides to relocate to one state compared to another.

For example, if one is considering relocating to a state with no income taxes, such as Washington State or Florida, it might be interesting to note that Washington has one of the highest marginal estate tax rates (20%) and is also ranked as the 4th highest taxed state from a sales and excise tax standpoint. Florida, on the other hand, doesn’t have a state death tax, and its level of state and excise tax is considerably lower, ranked 28th.

Summary

There are many areas that people nearing retirement need to explore and educate themselves on before deciding to relocate to another state. For just about everybody, affordability and the cost of living are significant determinants of where to live during the retirement years. Included in that calculation is the impact one can expect from future taxes, and the fact that the taxes which seniors are subject to during retirement can vary greatly depending on where they live.

The Advanced Planning and Advisory team at Clearwater Capital Partners can provide guidance and comprehensive planning that looks to address such questions as whether relocating to a different state makes financial sense based on one’s situation.

Nothing contained herein is offered as legal or tax advice. Please consult qualified professionals with any tax planning needs or tax questions that you may have. For more information regarding state taxes, please visit taxfoundation.org and IRS.gov.

Information updated on August, 5, 2025

John E. Chapman Chief Executive Officer

John E. Chapman Chief Executive Officer