Enhancing Employee Financial Wellness with Health Savings Accounts (HSAs)

As autumn ushers in a season of change, it is a great time for HR leaders and Plan Sponsors to rethink how employee benefits can support long-term financial wellness.

Just as the leaves turn and temperatures drop, employees’ financial needs evolve – particularly when it comes to healthcare and retirement planning. If you haven’t yet integrated Health Savings Accounts (HSAs) into your benefits package, now could be the perfect time to consider this option as you help employees plan for their long-term financial future. If you do offer an HSA as part of your benefits program, remind employees of the power of the HSA – not only a healthcare savings tool, but also a retirement savings tool. Consider building these communications into your employee financial wellness strategy. Your Clearwater Capital Partners Plan Advisor can assist you with this.

HSAs provide employees with a triple tax advantage—contributions, earnings, and withdrawals for qualified medical expenses are all tax-free. These accounts empower employees to save for both current and future healthcare needs, alleviating the stress that comes with rising medical costs.

In addition to healthcare savings, HSAs serve as a powerful complement to a 401(k) plan. By encouraging employees to maximize both their HSA and 401(k) contributions, they can build tax-efficient savings for retirement while addressing healthcare expenses that may arise in their later years. Offering employer contributions to HSAs, alongside 401(k) matching, further reinforces this dual strategy, supporting employees’ long-term financial security.

As we approach 2025, provisions of SECURE 2.0 take effect for employees earning over $145,000, who will now be required to make catch up contributions on a Roth basis, which are taxed upfront. HSAs continue to provide tax deductions for these high earners as HSA contributions remain pre-tax, offering a valuable way to reduce taxable income.

As the seasons change, consider positioning HSAs as a core part of your financial wellness initiatives. It is the perfect time to help employees take control of both their retirement and healthcare savings, creating a more resilient and financially empowered workforce.

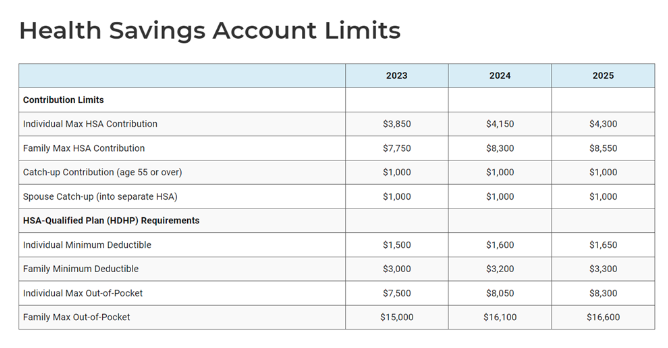

Source: hsaconsultingservices.com/has-limits

This marks the second year in a row that employer-sponsored health insurance premiums are up 7%, according to KFF’s annual survey

Source: www.kff.org/health-costs/report/2024-employer-health-benefits-survey)

John E. Chapman Chief Executive Officer

John E. Chapman Chief Executive Officer