One of the most significant drivers of the poor performance of the stock market this year has been the dramatic rise in interest rates, which are moving higher in response to the Federal Reserve’s battle against inflation. As rates have moved higher in 2022, stocks have fallen. That relationship is based on the uncertainty around how high the Federal Reserve will need to take rates to get inflation under control, and whether they will be forced to raise rates to a level that will cause a recession. However, history tells us that stocks tend to bottom and begin the recovery rally well before inflation is “under control” and, typically, well before the Federal Reserve has finished raising interest rates. They also tend to bottom before the economy exits recession.

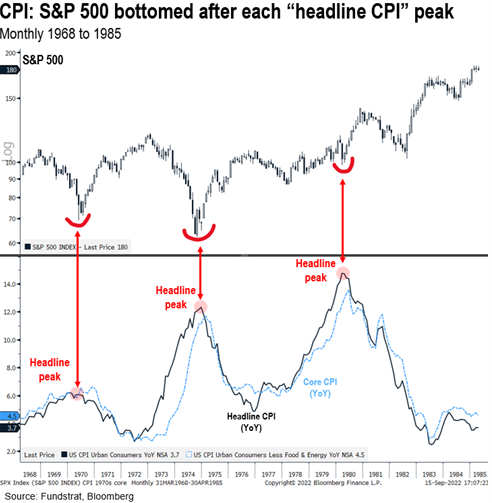

First, let’s review how the S&P 500 behaved during the last major inflationary period, the late ‘60s through the early ‘80s. As the chart to the below shows, the S&P 500 showed a clear bottoming pattern as inflation peaked in each of the three consecutive inflationary cycles. (SOURCE: FS Insight)

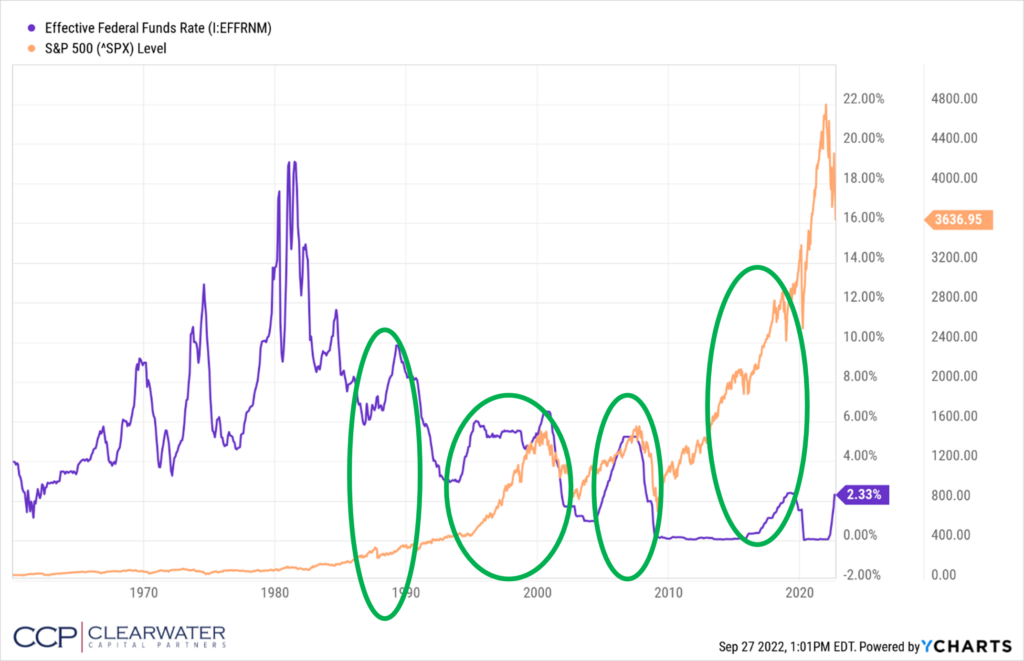

Next, we look at the relationship between the Fed Funds Rate, the mechanism the Federal Reserve uses to manipulate interest rates, and the S&P 500 over time. While there are a variety of factors at play here, we can see multiple examples through history where the S&P500 was able to rise as the Federal Reserve raised interest rates. In fact, markets have generally performed well in rising rate environments until those rates reach an overly restrictive level, generally around 5%, leading to recession. Of course, this time around markets have behaved contrary to this historical pattern, with stocks dropping as rates rise as fears of a recession continue to grip markets. Granted, the unprecedented speed of interest rate increases, which are the fastest pace in over 40 years, has certainly justified those fears.

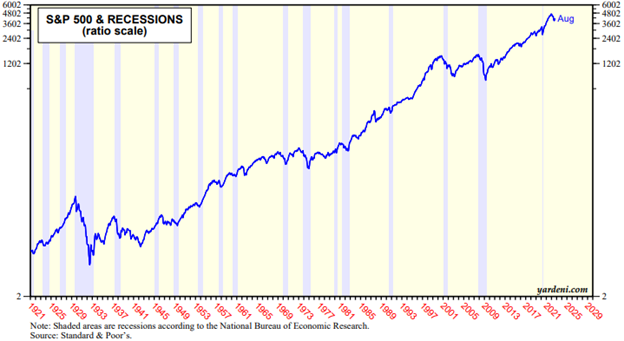

Yet, in many cases, markets actually perform fairly well after the recession actually comes as the damage has been priced in before it actually happens. In the chart below, where the blue vertical bands represent recessions, the S&P 500 bottoms and begins trading higher well before the recession ends and the vertical blue bands disappears. (SOURCE: Yardini Research, Inc) This is the case almost universally with the only exception being the recession of 2001, where the dot-com stock market bubble drove valuations to excessively high levels, well above valuations seen at the beginning of 2022. The trend is clear, stocks start improving before the economy does.

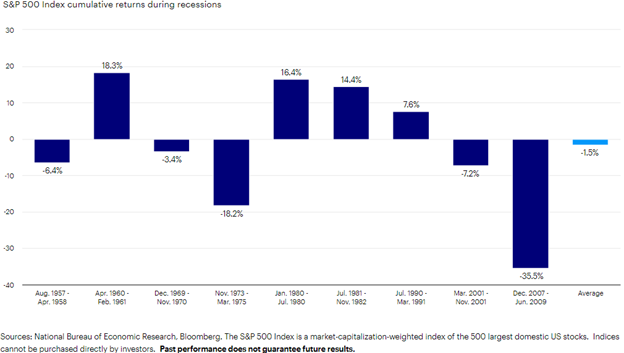

In fact, total S&P 500 performance during recessions is decided mixed. As seen in the chart below, there have been multiple recessions where the S&P 500 ended the recession above where it started. (Source: Invesco) In these cases, the damage was done in the stock market before the recession began.

Markets are forward looking, discounting mechanisms. This means their performance tends to lead actual events. In other words, markets tend to fall before a recession actually begins and rise before it ends. They look through the current landscape to what is coming down the line and price themselves accordingly. While we don’t know that a recession has officially begun, or that inflation has officially peaked, we do have conviction that there will, eventually, be better times ahead. Markets will not wait until things feel better, nor for the data to improve, to bottom. History tells us that those with the patience to wait out the weak periods have been rewarded over the long term.

John E. Chapman

Chief Executive Officer

John E. Chapman

Chief Executive Officer