What is it and can it still apply today?

When people approach retirement, the question that they often ask themselves is:

What amount can I withdraw from my retirement asset bucket to meet my ongoing spending needs and sustain my nest egg over time? In other words, how much can I spend each year without outliving my money?

The 4% Withdrawal Rule: Defined

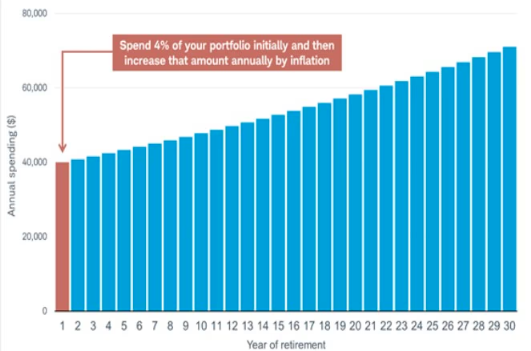

In the financial planning world, the 4% withdrawal rule has been used as a simple rule of thumb for many years as a starting point when addressing the above questions. The 4% rule suggests that you can withdraw 4% of the total amount of your retirement savings in the first year and adjust that amount by the rate of inflation for each subsequent year.

Historically by following this 4% withdrawal method, the probability has been quite high that a pool of retirement savings will last 30 years or more.

Here’s a simplified example of this: If you have $1 million saved for retirement, the 4% rule suggests that you can withdraw $40,000 in the first year ($1 million x 4%) and then increase this amount at the rate of inflation in the following years (i.e. 2% inflation rate shown in the illustration below).

The 4% rule also assumes that the retirement savings bucket is invested in a diversified mix of stocks and bonds (approximately 50% in stocks and 50% in bonds) and that the retirement funds are held in tax-deferred accounts such as a 401(k) or traditional IRA.

One must remember that the 4% withdrawal rule comes with a major caveat in that it is not really a “rule” that everybody should adhere to since everyone’s situation is different.

For example, if you own a large retirement investment portfolio, you might not even need to withdraw close to a 4% inflation-adjusted rate in order to live a comfortable retirement. On the other hand, if you have limited savings (or sources of income), a 4% rate of withdrawal might be insufficient to cover your needs.

The 4% Withdrawal Rule: Factors to Consider

There are many factors to consider before you adopt a 4% retirement withdrawal strategy, or any set spending rule during your retirement years. Those include:

- Pace of spending and Inflation. Expenses may fluctuate from year-to-year depending on your life circumstances. Years with higher inflation rates could also have an impact on how much more you’ll need to spend on necessities. If inflation is higher than expected or if your spending needs increase, the 4% rule may need to be adjusted upwards. Also, the 4% rule assumes a consistent rate of inflation and spending, which isn’t realistic.

- Market conditions. A period of lower interest rates or investment returns could mean that a 4% withdrawal rate might be too high. In a low-return environment, retirees may need to withdraw less in order to ensure that their savings will last.

- Sequence of returns risk. If the markets experience more downturns than upturns early in your retirement, it is possible that your retirement savings bucket may not last as long as it would otherwise if the down years come later.

- Health risk. As we get older, more doctor appointments and higher medical bills are more likely, and these bills are often unplanned and unexpected. During the retirement years, the average 65-year-old couple currently will spend over $300,000 on medical expenses (Source: www.prudential.com). The occurrence of such costs could significantly bump up expenses in excess of a planned-for withdrawal amount in a given year.

- Longevity risk. People, on average, are living longer, which means retirement could last more than 30 years. According to the U.S. Census, more than 60,000 women (and nearly 15,000 men) were over age 100 in 2020. This increased longevity may require a more conservative approach to the rate of withdrawals.

- Social Security. The 4% rule assumes that you’ll also receive your full Social Security benefits that you would expect to receive based on your age, career earnings, and when you start taking them. With the possibility that the Social Security system may have to make benefit adjustments in the future (i.e. perhaps with declining benefits in some instances), the amount of cash withdrawals from your retirement portfolio may need to be adjusted upward.

- Taxes from retirement account withdrawals. The more you withdraw from your retirement accounts to meet your cash flow needs, the greater the amount of taxes that will be due. This is assuming that, as noted above, the distributions to meet your retirement needs are drawn strictly from tax-deferred accounts such as traditional IRA, 401(k) and 403(b) accounts (and not from other tax-advantaged accounts such as Roth IRA, Roth 401(k) or after-tax savings and investment accounts).

The 4% Withdrawal Rule: Alternative Approaches to Address Long-Term Cash Flow Needs

- Use a dynamic approach when making withdrawals. Instead of sticking to a rigid 4% withdrawal rate, consider making slight adjustments to your withdrawal strategy based on different market environments. For example, when markets are performing well, you might consider increasing the amount you withdraw. On the other hand, when markets are experiencing a period of lower returns, reducing your spending and the amount you withdraw (below a set rate such as that determined by the 4% rule) might make sense.

- Spend at a reduced pace. You might need to spend less than expected in retirement, at least initially, in order to increase the probability that you will not outlive your long-term savings bucket. For example, Morningstar recently recommended starting with a withdrawal rate of just 3.3% from your retirement savings bucket and then increasing the withdrawal amount during good market years or when you have more confidence that the portfolio will sustain itself over time.

- Consider using a bucket strategy. This approach involves separating your assets according to when you plan on making withdrawals. This involves creating a cushion of cash during the earlier years of your retirement and maximizing the rest of your nest egg over the long term. More specifically, you can set aside in a cash/money market fund account enough to meet your living expenses over a set period such as a year or two. This amount will not be dependent on your other retirement assets, which will be earmarked more towards longer-term growth and income. You can even go further by creating different investment account buckets that are targeted towards your short, medium and long-term needs.

- Utilize or maximize other income sources. If you’re able to cover your retirement expenses with other income, such as by working part-time, it could help to conserve more of your retirement nest egg and decrease your need for account distributions. Also, if you are in a situation where you are not dependent on Social Security income in order to meet your cash flow needs, consider delaying Social Security until age 70. This will not only maximize your monthly Social Security benefit, but it might also reduce the withdrawal amount needed from some of your tax-deferred retirement accounts in the future (this doesn’t account for the mandatory distributions that must be made by those who have reached requirement minimum distribution age status, which is currently 73).

Source: www.prudential.com

The transition from saving for retirement to spending after the working years can be difficult, and not knowing how much to efficiently withdraw from one’s retirement pool of assets to make ends meet is a challenge for many. The 4% rule provides a useful starting point, and this post touches on just a few of the many issues to consider when determining a suitable withdrawal rate for meeting retirement needs.

Setting up a plan that incorporates general guidelines for spending during retirement, but which also addresses those specific what-if scenarios that might occur in the future, is important. The Advanced Planning and Advisory team at Clearwater Capital Partners provides in-depth income modeling and comprehensive financial planning, which helps individuals and couples address their cash flow and overall planning-related questions before and during retirement. Please don’t hesitate to reach out to us with any questions you may have.

20240904 – 4

Note: Nothing contained herein is offered as tax advice. Please consult qualified professionals with any tax planning needs or tax questions you may have.

John E. Chapman Chief Executive Officer

John E. Chapman Chief Executive Officer