What Just Happened?

The S&P 500 finished the month of March down about 10% from its recent all-time closing high of 6,144 achieved on February 19, 2025. While I have been forecasting a market correction in 2025, this one has been swift and brutal. In fact, this was the fifth fastest correction since World War II.

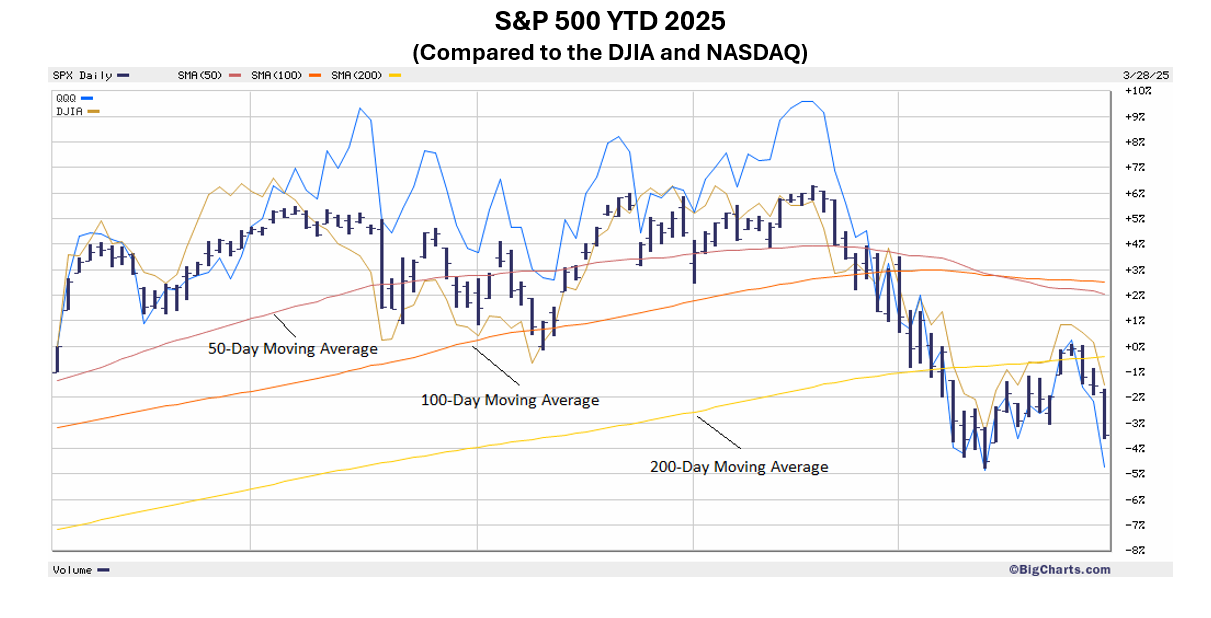

The S&P 500 initially dropped over 10% in just 16 trading days and the stock index decisively broke key bull market support on March 7th, when it breached its 200-day moving average – only 12 days into the correction. After marking an intermediate low on March 13th, we saw a short-lived countertrend rally that retraced about 4% of the decline only to fail to reestablish the 200-day moving average support level.

Such snapback rallies are not uncommon during market corrections, and I do not recall a single “first” rally that did not ultimately disappoint. Normally, markets must establish a reliable bottom with one, often times multiple, retest of the lows before a countertrend rally can be trusted. Not surprisingly, the downtrend resumed in the final days of March.

The Dow Jones Industrial Average (DJIA) by comparison, has fared a little better than the S&P 500 (given less sensitivity to the Magnificent Seven) while the NASDAQ has suffered the greatest losses in this correction cycle – falling about 15% from its February highs.

Market corrections are a normal part of the stock market investment cycle occurring on average, about once every 12 months. The current correction cycle likely feels especially troublesome to some investors due to the sudden and swift nature of the decline, and the fact that the market has not seen a true correction since 2023.

How Did We Get Here?

The markets have been riding a wave of multiple expansion and optimism for more than a year. Economic activity appeared to be resilient, earnings were good, and many believed the Fed would soon loosen monetary policy based on the viewpoint that the inflation problem was behind us. November’s election led many to conclude that pro-growth economic policies in Trump’s second term would quickly unleash a new surge of economic activity. The soft-landing narrative appeared to be the winning theory.

The trouble with such widespread optimism is that when everyone starts seeing and saying the same thing, something else usually happens. This explains why I have been decidedly more cautious over a “priced for perfection market” and the rising risk of near-term market volatility. Classic contrarian thinking teaches that prevailing market sentiment and behavioral biases can create challenges for investors over the short run.

For more than a year, I have observed that a recession in the U.S. economy was a possibility. I noted that inflation remained a problem and that much of the economic “resiliency” we were seeing could be attributed to large deficit spending initiatives by the Federal government. A disproportionate amount of economic activity being fueled by this stimulus was job growth. It is estimated that nearly 40% of all jobs created in the U.S. last year were government and social services jobs.

My concerns extend to housing affordability, record consumer debt levels, and rising credit delinquency rates. Manufacturing data in the U.S. has been contracting for about a year and a half and the services sector is beginning to show a noticeable decline in discretionary spending; evidenced in the recent hospitality and restaurant spending numbers.

Over the past six weeks, we have seen a conspicuous decline in consumer confidence accompanied by a surge in uncertainties. The Conference Board consumer sentiment measure is now below their COVID lows. It is as if investors have become suddenly worried about the potential impact of trade policies despite the clear signals from President Trump of his intentions to use tariffs to make global trade fairer to the U.S.

Without assuming a political position relative to the Trump administration’s economic policies, I do believe that some of these policies will eventually promote greater levels of prosperity. Expanded corporate investment, lower taxes, less regulation, reshoring manufacturing, promoting energy production, and a focus on productivity growth, all have the potential to be very positive for the economy. This said, these policies will take time to produce the intended results and 2025 will be a year of transition and disruption.

There was too much optimism coming into the year and it is interesting to see how quickly many previously bullish analysts are now lowering earnings estimates, year-end S&P 500 targets, and advocating for “risk aware” strategies.

None of the above should be taken to suggest that my economic forecasts are superior to those of other Wall Street players. On the contrary, while some of my previous reservations may now be catching up to the market’s high expectations and valuations, I must admit that I was very early in forming these worries. While momentum alone can move markets well beyond fundamental explanations, a defensive posture in periods like 2024 can lead to modest returns when compared to strategies built on bullish sentiment.

Still, being early is often better than being late, and there is an old saying that there is nothing wrong with winning by not losing. This refers to a well-established investment philosophy focused on capital preservation and avoiding large losses, rather than chasing high-risk, high-reward opportunities. We believe there are times to lean into opportunity and then there are times when minimizing mistakes and protecting capital can lead to superior outcomes over time. We believe this may be a time to protect capital.

The Challenges are Mounting

Slowing economic data and continued sticky inflation have put “stagflation” back on the table of major challenges for investors. It is widely understood to be one of the most damaging economic scenarios because it combines three destructive forces: stagnant growth, high inflation, and rising unemployment. The policy response to any one of these factors often makes the others worse, leaving the government and central banks with few options for turning things around.

Some economists are now warning that 2025’s stagflation risks could mirror the 1970s, demanding painful trade-offs between growth and inflation control. With the Fed’s hands tied, households and markets could face prolonged uncertainty, making stagflation a uniquely dire economic threat (Forbes).

The Atlanta Fed’s GDP Now model currently estimates that U.S. GDP growth for the first quarter of 2025, will contract by -2.8% on an annualized basis (as of March 28, 2025). This marks a significant downward revision from earlier projections, which initially indicated growth, even if the pace of growth was marginally slowing. This model has now shifted to contraction, due to weaker-than-expected consumer spending and export performance.

Credit spreads have been widening and the Conference Board’s Leading Economic Index (LEI) for the U.S., has marked its third consecutive month of decline. While it is still too early to suggest the economy is moving into recession, it is fair to say that economic realities are shifting rapidly. It will likely be many months before we can confidently assess the current assortment of uncertainties.

Looking beyond traditional measures of economic activity, it is worth noting that political and geopolitical tensions are quite elevated. The U.S. population remains deeply divided and distrusting of the people (and their motives) on the other side of the political aisle. The cease fire talks between Ukraine and Russia look to be stalled and President Trump appears determined to dismantle Iran’s nuclear armament capabilities – with a frightening sense of urgency.

On this last issue, President Trump has threatened severe consequences, including unprecedented bombings and secondary tariffs, if Iran refuses to comply. He emphasized that military action would be taken if Iran does not strike a deal with the U.S. regarding its nuclear program.

The Blackrock Geopolitical Risk Indicator (BGRI) measures market attention to geopolitical risks by analyzing the frequency and sentiment of news and analyst reports, with higher scores indicating elevated market concern. According to their analysis, the world is facing dramatic geopolitical change. It has become more fragmented and unstable, in our view. It is more protectionist, entering a new era of trade disputes with the current global trading system under extreme pressure. Clearly, investors have a lot on their plate when attempting to navigate this mix of challenges.

So, Where to From Here?

The question is whether the selloff continues towards a deeper 20% correction where it officially crosses over into a bear market, or will conditions stabilize with this correction more closely approximating the historical average of a 14% decline. Of course, no one can know what the future will bring, but we can observe various relevant factors for possible clues.

First, even with the current correction, equity valuations remain elevated. Brian Wesbury, Chief Economist at First Trust, recently observed that all the established valuation methodologies, including the Shiller CAPE, Price/Sales, Price/Book, and Price/Future Cash Flow, are near record percentile rankings relative to history. Bob Doll at Crossmark Global Investments made a similar observation in his recent white paper “Crossroads or Crosshairs” wherein he observed that “concerns about meaningful downside risks to growth are valid”.

Still, there are a number of positive elements within the economy that must not be dismissed, and a number of prominent Wall Street strategists have thus far stood by their optimistic yearend forecasts.

In the midst of the current correction, Fed Chair Powell sparked a market rally when he offered a soothing tone at his last FOMC press conference earlier this month. Powell indicated that the economy was holding up well and that he wasn’t concerned with some soft-survey data points on forward inflation expectations. The Fed is still in easing mode and futures pricing is looking for the Fed Funds rate to work its way into the 3’s over the next year or two (BESPOKE).

Innovation, particularly the recent advances in artificial intelligence, leads the list of developments to be bullish about. Potential advances in productivity from such innovations are difficult to forecast, yet are likely to produce positive outcomes for years to come.

Market breadth has held up well, with the percentage of stocks making 52-week highs relative to those making 52-week lows, remaining positive. From a “seasonality” perspective, it can be observed that mid-February to late March has historically been a weak time of the year for the stock market. However, April has been a very strong month that has more than erased the February/March weakness over the last ten years. In fact, April ranks in the 87th percentile for market strength across all rolling one-month periods (BESPOKE).

Finally, the current correction cycle marks just the 7th time the S&P 500 dropped by 10% or more inside of a four-week period since 1952. In all but one of the prior six instances, the S&P 500 made a new all-time high within a year.

Conclusion

Given the complex fact pattern outlined above, I believe it is premature to be searching for a market bottom at this time. April 2nd stands out as a date by which we will know more about reciprocal tariffs. Also, ongoing negotiations around geopolitical hotspots are quite fluid. In other words, important factors are evolving very quickly, and we should know more in the coming days and weeks.

This said, there are various scenarios worth exploring.

- If the impact of trade policy turns out to be muted and inflation resumes a downward trajectory, the economy should be okay, and a recession would be averted. In this scenario, a market bottom for the year could be established in the mid-5,000s for the S&P 500. In this scenario, we would expect to see the stock market successfully retesting support levels while it forms a base from which the bull market could resume. Volatility would remain elevated, and confidence would remain low until geopolitical uncertainties moderate.

- If, on the other hand, the new tariffs are aggressive, and an escalating trade war emerges, we would likely see meaningful upward pressure on inflation and economic activity could grind to a halt (i.e. stagflation). Corporate profits would come under considerable pressure and unemployment could spike. In this instance, the government would likely struggle to find stimulus initiatives without pressuring inflation higher and expanding the deficit (potentially sending interest rates higher). As mentioned above, the stagflation setup is a particularly difficult one. In this scenario, a recession would be likely, as would be a bear market. Equity prices could sink to the mid-4,000s before finding a bottom.

- If a worst-case scenario were to emerge with military conflicts around the world escalating significantly, a deeper recession and bear market would likely develop. In this seemingly unlikely circumstance, equity prices could shed 40% or more of their value depending on how protracted the conflicts became. Suffice it to say, this worst-case scenario would be devastating for the entire globe.

- It is worth ending this letter with one final scenario – my base case for 2025. The cornerstone of our Outlook 2025 report was that 2025 would be a transitional year as the new administration moved aggressively to reform many economic policies simultaneously. The Outlook report correctly forecasted an uptick in market volatility and a market correction in 2025.

While significant transitions have the potential to be very disruptive, they also have the potential to yield significant improvements. Tariffs, if properly administered, can help rebalance global trade and produce a boon for U.S. manufacturing. Less regulation and lower taxes had a very positive impact on the economy in President Trump’s first term.

I think the U.S. economy has enough resiliency to withstand the disruption. I also believe the Trump administration will go to great lengths to adjust the pace and magnitude of disruption, as to avoid a significant downturn.

In this scenario, a short and shallow recession remains a possibility with equity prices moving to the low 5,000s, and then mostly sideways for the next six months. I believe the positive outcomes associated with many of Trump’s economic policies will begin to materialize later in 2025, and equity prices will achieve new highs in 2026.

Clearwater Capital investment policy currently maintains a neutral posture relative to core U.S. equity exposure. In most of our strategies, we have over weighted international equity while maintaining a defensive posture within the fixed income class (high quality / short duration). So far, this combination has served us well in 2025.

Looking forward, we believe this type of orientation will temper the effects of further market volatility and potentially allow for rebalancing opportunities related to any additional dislocation in equity prices.

As always, thank you for your continued confidence in our abilities to help you navigate the many challenges associated with growing and protecting your wealth.

John E. Chapman

Chief Executive Officer

Chief Investment Strategist

20250401 – 1

John E. Chapman

Chief Executive Officer

John E. Chapman

Chief Executive Officer