Wealth Transfer Planning

The objective of wealth transfer planning is the conservation and efficient transfer of assets to the desired beneficiaries. Goals are set and a strategy is developed to maximize the value of the transfer while minimizing the impact of expenses and tax costs.

Background

A couple preparing for retirement with a desire to create a transfer plan that ensures a legacy to their children and grandchildren.

Male – age 63 Female – age 65

Excellent health Excellent health

Surgeon retiring in 5 years Family practice doctor retiring in 3 years

Household income: $650,000 Household net worth: $12,400,000

Two adult children both pursuing a career in medicine.

goals

The plan would lock in a base level of assets to transfer providing peace of mind that regardless of lifestyle, medical expenses, and charitable giving their legacy is fixed and always intact.

Desired features:

Predictable legacy

– Base legacy benefit fixed upfront and fully available regardless of their date of passing

– Benefit would not be subject to market fluctuations – no risk of dying in a down market

– Minimize or eliminate the negative impact of taxes

– Plan would be simple to implement and maintain

With a legacy fixed and established, retirement living expenses are not a concern

– Ability to seek out the highest quality health care, nursing, and support services

– No burden on children financially or for care delivery

– Allow for spending freely on lifestyle, travel, and housing

– Charitable giving pursued with no negative impact on legacy benefit

strategy

Life insurance owned in an Irrevocable Life Insurance Trust (ILIT) is determined to be the most tax-efficient strategy to achieve all the desired goals.

Life insurance

- Death benefit owned by the trust is income and transfer (estate, state inheritance) tax-free

- Leverage makes life insurance a competitive legacy asset

- Simple to implement and maintain (single premium) and entire benefit available from day one

Plan design

- Single gift into trust (premium) to utilize the current high lifetime exemptions

- Two different insurance companies and policies selected for diversification

Policies purchased

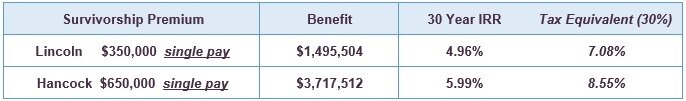

Policy: John Hancock Survivorship Universal Life

Death Benefit: $3,717,512

Single Premium: $650,000

Policy: Lincoln Survivorship Universal Life

Death Benefit: $1,495,504

Single Premium: $350,000

Total

Death Benefit: $5,213,016

Single Premium: $1,000,000

tools

Life Insurance

Features that make life insurance an excellent option for wealth transfer planning

Day one benefit:

At issue (day one) of a life insurance policy, the entire benefit is available. In this case, $5,213,016. There is no time period that has to pass before the benefit is accumulated.

Non correlated benefit:

Life insurance death benefit is fixed and does not fluctuate over time. The benefit is not correlated to a particular rate of return, interest rate, or market performance.

Leveraged Benefit

Life insurance provides a leveraged benefit. For every dollar of premium paid, an amplified, larger benefit is created. The younger and healthier the insured, the greater the leverage.

In this case, $1,000,000 invested in life insurance yields a legacy benefit of $5,213,016.

For comparison purposes, how does this benefit compare to investing that same amount ($1,000,000) in an investment account?

The internal rate of return, IRR, on a policy measures annually the rate of return an investment would need to achieve to match the death benefit of the policy. For these clients, an investment would need to exceed an average return over 7% after-tax for 30 years (past their life expectancy) to accumulate to a value greater than the death benefit. This competitive IRR and the benefit availability regardless of their date of passing made life insurance a good fit for achieve their goals.

Survivorship policy:

A survivorship (second to die) policy was selected due to better pricing and leverage than a single life policy. A survivorship policy insures both spouses in one policy and pays out the death benefit upon the passing of the second spouse.

Tax benefits:

Life insurance proceeds are income tax free and can be excludable from the taxable estate if the policy is properly structured and owned by an irrevocable trust.

Irrevocable Life Insurance Trust (ILIT)

An ILIT is an estate planning tool that is designed to be the owner and beneficiary of life insurance. Shifting the ownership of the insurance away from the grantor (insured) removes the death benefit from the gross estate and avoids federal estate and state inheritance taxation.

The premium for the insurance is a gift into the trust from the grantor, creator of the trust. Annual premiums can be paid by the grantor utilizing the annual gift tax exclusion. In this case, the single premium is a gift that utilizes a portion of their lifetime exemption.

Other factors related to making a single premium instead of ongoing annual premiums:

- They had the liquidity to make the large, one time gift

- The likelihood the high lifetime exemption opportunity will be gone in 2026 or perhaps sooner

- Simplifies the process and no need for annual gifts, premiums

- Higher leverage with a single pay vs. spreading out the premiums

The trust is the beneficiary of the policy death benefit and the terms of the trust determine how the proceeds are distributed.

conclusion

With a legacy benefit established and available from day one of the policy, they now have the piece of mind to spend freely, live comfortably, give generously and be cared for professionally. The leverage of life insurance and the tax advantages of trust ownership make this strategy ideal for accomplishing this couples’ wealth transfer goals. Any remaining assets in their estate will also be passed on but they can take comfort in knowing there is a base level of wealth that will pass in a timely fashion without fluctuation or shrinkage from taxes.

John E. Chapman

Chief Executive Officer

John E. Chapman

Chief Executive Officer