Digital assets have evolved from computational experiments into an industry moving trillions of dollars across public blockchains, decentralized finance (DeFi) protocols, and tokenized representations of traditional assets.

Public Blockchains

Public blockchains are open, permissionless ledgers secured by economic incentives, rather than a central administrator. The vision for establishing a unifying ledger based on cryptography rather than a central administrator (such as a commercial or central bank) was founded on an ideological desire to promote personal privacy and censorship resistance to third parties.

The primary challenge in establishing this trusted ledger is how to prevent the ‘double-spending’ problem. In digital transactions, it is frictionless to copy and reuse digital tokens or ‘coins’. This could result in any actor fraudulently copying digital ‘coins’ and using those copied coins infinitely, effectively breaking the system. Traditionally, this has been resolved through a third-party intermediary, such as a bank, which verifies and settles transactions between parties. The trade-off is that this gives centralized authority to the intermediary, which exposes individuals to the aforementioned censorship and privacy concerns.

This issue of preventing the double-spending problem was first publicly resolved by an anonymous author, Satoshi Nakamoto, who replaced the third-party intermediary with a computational ‘proof-of-work’ consensus mechanism (driven by bitcoin miners) coupled with cryptographic auditability that validates and records all transactions in a public, auditable, and tamper-resistant manner, on the Bitcoin protocol. How this consensus mechanism works is complex, but at its foundation, it is effectively simple game theory, which ensures that bitcoin miners find it more profitable to ‘play by the rules’ in accurately validating transactions on the ledger, rather than permitting fraudulent transactions1.

The native ‘coin’ for this protocol is bitcoin, and over the past 15 years, the value of this coin has appreciated tremendously, from a few cents in 2010 to a current market price of $113,183 per bitcoin, or an overall market capitalization of $2.25 trillion2, as of August 19, 2025.

The technological disruption of traditional third-party validation of transactions was further extended with the introduction of the Ethereum protocol in 2015. The Ethereum protocol, which makes use of an alternative computational consensus mechanism known as ‘proof of stake’, established further programmability into its protocol, allowing for the use of ‘smart contracts’. These are further explored in the following section on decentralized finance.

Since 2015, beyond Bitcoin and Ethereum, there has been a significant expansion of competing protocols that have differentiated value in terms of programmability, consensus mechanism, speed, and governance relative to each other. For instance, Solana, Cardano, XRP Ledger, and BNB Chain are additional protocols with digitally native coins, competing with each other based on the economic merits of their underlying protocols.

Decentralized Finance (DeFi)

Smart contracts are effectively computer code that automatically execute all or parts of an agreement between parties on a unifying underlying protocol (such as Ethereum)3. Critically, this invention has unlocked a wave of innovation, often referred to as ‘decentralized finance’ or ‘DeFi’, which describes market activity that operates without ‘centralized’ intermediaries, allowing actors to transact directly with one another.

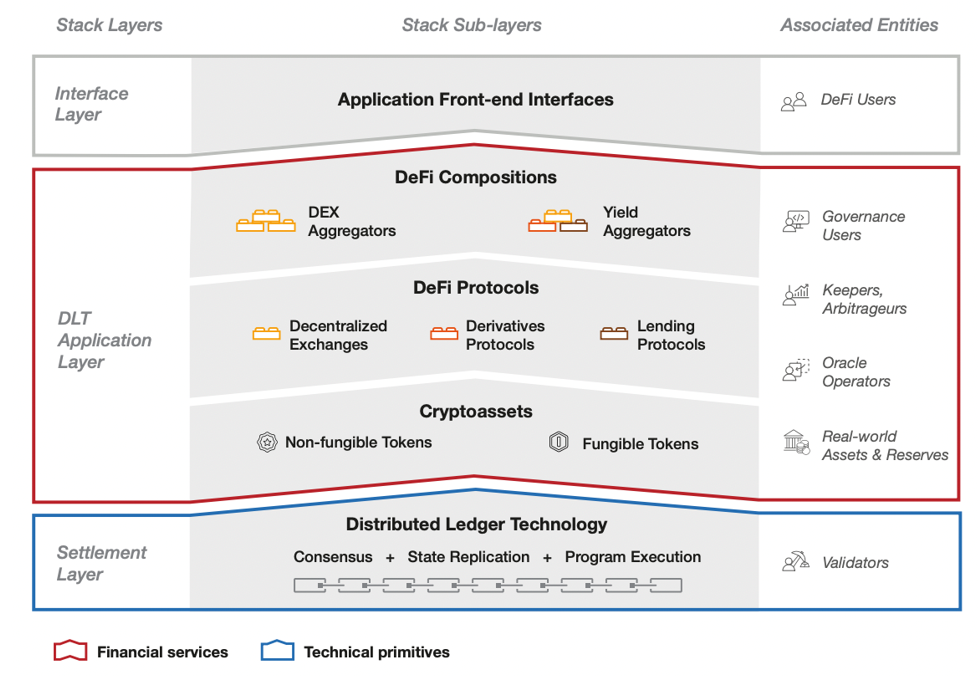

The Bank for International Settlements divides the DeFi technological ‘stack’ into settlement, asset, and application layers (Figure 1)4.

Figure 1: DeFi Stack Reference (DSR) Model, BIS

The Settlement Layer enables the ledger-based agreement to be replicated across the decentralized protocol. The Application Layer is effectively where and how smart-contract and protocol developers establish the codebase for executable smart-contracts, and the Interface Layer is how actual users (consumer or institutional) of DeFi applications interact with the underlying Application and Settlement layers.

DeFi is effectively deconstructing and reconstructing traditional financial system functions, such as lending, exchanges, and derivative functions, but without centralized intermediaries5. For instance, this includes automatically enforcing loan collateral ratios or market‑making algorithms once pre-defined conditions are met.

A few examples of mainstream DeFi protocols in the market today include Uniswap (automated market‑making for spot exchange) and Compound (over‑collateralized lending), which together process tens of billions of value (USD) in monthly volume.

Stablecoins

The creation of stablecoins is a subset use-case within DeFi, which involves digital tokens designed to maintain a fixed fiat value—typically $1 USD. Historically, there are three types of stablecoins:

- Fiat-collateralized stablecoins – Designed to maintain their fixed value through the issuer holding a portfolio of cash or money-market instruments, like U.S. Treasuries.6

- Crypto-collateralized stablecoins – Similar to fiat-collateralized stablecoins, but instead, the portfolio consists of a basket of over-collateralized crypto-assets, which is most often bitcoin.6

- Algorithmic stablecoins – Designed to maintain price stability by dynamically adjusting (through algorithms) the supply of stablecoins based on demand. When demand increases, the stablecoin issuer would mint new coins; when demand decreases, the issuer would buy back coins from the market and ‘burn’ (or destroy) those coins.7 These can have a higher risk of losing their ‘stable’ value, for instance, when there is significant sell pressure, challenging the ability of the issuer of the stablecoin to redeem, as exemplified below in the case of Terra and UST.

From an investment standpoint, the function of stablecoins is distinct from other digital asset tokens (or ‘coins’). Whereas the pricing of other tokens fluctuates in price by design, stablecoins are designed to be exactly that – stable. This allows for a number of market functions, such as facilitating trading on exchanges, settlement between actors, and acting as a safe haven during periods of market volatility. Exactly how ‘stable’ these coins are will be explored in the following section.

The incentive for the stablecoin issuers is self-evident. Fully‑reserved issuers accept fiat currencies, for instance, U.S. dollars, and in turn disburse digital tokens. The issuer then invests reserves for returns (ranging from US Treasuries to more speculative instruments), while offering token redemption on demand.

However, not all stablecoins are created equal, and not all are equally ‘stable’. For instance, in early 2022, Terraform Labs, which, among other DeFi activities, was the issuer of algorithmic stablecoin UST. By May 2022, UST in circulation was in excess of $18 billion8. However, being algorithmically backed, left UST vulnerable to a George Soros-style attack9 on its ‘peg’ to the US dollar, essentially its ability to maintain a 1-to-1 market value against the US dollar. In early May 2022, this is effectively what transpired, with UST ‘de-pegging’ in value from the US dollar, leading to a spiral of sell-off activity. This ultimately resulted in the collapse of UST, Terraform Labs, several of its financial investors, such as Three Arrows Capital, and a detrimental impact on millions of firms and individuals with UST or Terraform Labs financial exposure.10

As a result of market events like this, algorithmically-backed stablecoins now have very limited market adoption, and market-leading stablecoin issuers place a heavy emphasis on monitoring adequate reserves that are transparently disclosed.

Convergence with Traditional Finance: CeFi as Bridge

Finally, particularly over the course of the past 5 years, the schism between the traditional financial system and the digital assets system has narrowed through regulatory clarity and the emergence of firms and products designed to bridge this gap. These firms, operating within what’s known as ‘Centralized Finance’ (or CeFi), connect the digitally native world to traditional finance (TradFi) by providing custody, fiat on and off-ramps, and compliance services. A few examples of firms in this space are Coinbase and Kraken, which run regulated exchanges, and Elliptic, which offers blockchain analytics for anti‑money‑laundering compliance.

Digital Assets Current Market Dynamics

Needless to say, the evolution of digital assets over the past decade and a half has been rapid, tumultuous, and sometimes opaque. The following is a review of some of the more recent market action with respect to DeFi and its intersection with traditional finance.

Bitcoin’s continued market adoption

Bitcoin, long regarded as the foundational digital asset and benchmark for the broader crypto ecosystem, has witnessed a significant resurgence in institutional legitimacy and mainstream adoption with the introduction of spot Bitcoin exchange-traded funds (ETFs) in major markets. The approval of the first U.S. spot Bitcoin ETFs by the Securities and Exchange Commission (SEC) in January 2024 has been a tailwind for the asset class, leading to wider adoption by blue-chip financial institutions.

As of June 2025, there are more than a dozen spot Bitcoin ETFs actively trading in U.S. markets, including offerings from asset management firms such as BlackRock, Fidelity, and ARK Invest. Collectively, these funds now hold over 1.3 million BTC, equivalent to more than 6% of Bitcoin’s circulating supply.11 The largest among them—BlackRock’s iShares Bitcoin Trust (IBIT)—has surpassed $87 billion in assets under management as of August 2025.12

In addition to its institutional adoption, long-Bitcoin investors, such as ARK Invest and Strategy (formerly MicroStrategy), advocate for Bitcoin’s resilience to selling pressure, uncorrelated relationship with equities, and its increasing role as a ‘safe haven asset’ market action as indicative of expected continued pricing growth.

However, the market is far from consensus in terms of future return expectations on Bitcoin holdings, and risks remain in terms of regulatory, technological, and environmental exposure.

Ethereum commands the DeFi market

Total value locked (or ‘TVL’) is the leading indicator of commercial traction for public blockchains. It is measured as the value (as measured in USD) of assets deployed, or ‘locked’ in DeFi smart contracts. The function of this is effectively a proxy for understanding the liquidity of the protocol.13

As of August 2025, Ethereum TVL is roughly $87 billion, dwarfing the next largest protocol, Solana ($10.25 billion in TVL).14 The primary driver for Ethereum’s dominance is its first-mover advantage, developer ecosystem, integrations with institutionally significant actors (e.g. MetaMask, Chainlink, and Coinbase), and the degree to which Ethereum is decentralized relative to other open protocols, which acts as a proxy for Ethereum’s security and resistance to censorship.

This said, Solana, Arbitrum, and many other public blockchain protocols continue to gain traction with commercial and retail actors, as this DeFi ecosystem remains a hotly contested space.

Challenging ‘decentralization’ in DeFi

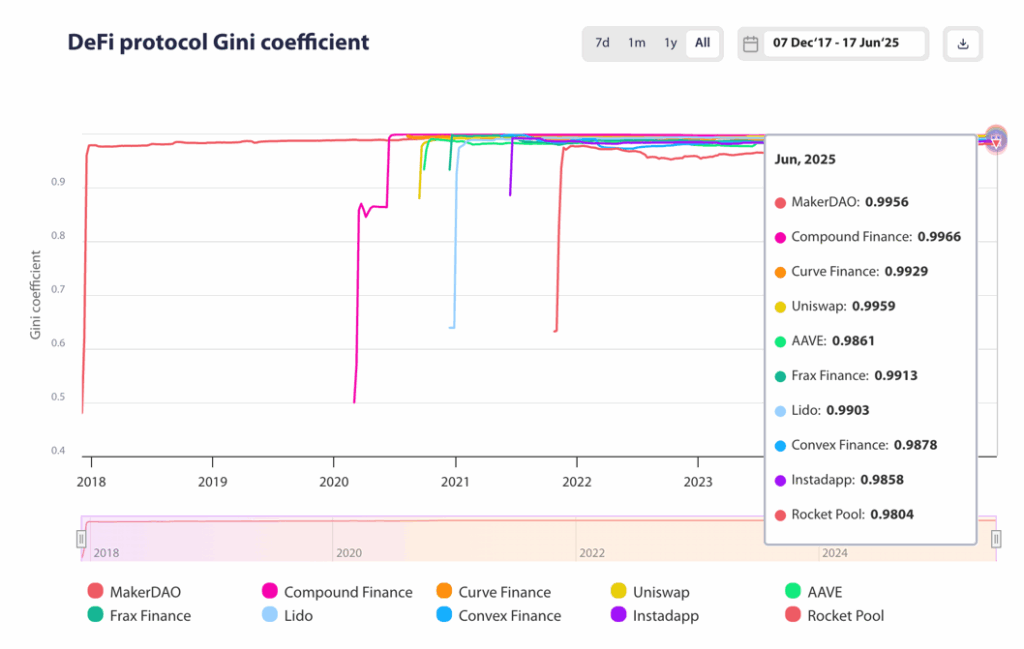

Despite the rhetoric of decentralization, mainstream DeFi applications, such as Compound, Uniswap, and the like, have highly concentrated governance control. The Gini Coefficient is a mechanism traditionally used to assess economic inequality. Still, it can also be applied to assess how centralized or decentralized a given DeFi application is based on the concentration of ownership of its governance tokens. Broadly speaking, governance tokens are the mechanisms through which an individual firm or institution can exert control over a DeFi application, and from which it benefits economically. They effectively act as a distributed substitute for how ownership shares function within a corporate structure. The more tokens one holds, the more influence one can have.

Based on research from the Cambridge Centre for Alternative Finance, the Gini Coefficient of governance tokens from market-leading DeFi apps shows Gini coefficients above 0.98 for leading DeFi applications, meaning a small number of persons (firms or individuals) have outsized control of a given DeFi application5.

Figure 2: DeFi Protocol Gini Coefficient

Source: CCAF, DeFi Navigator15

Commercial Tokenization Use‑Cases

Within DeFi, tokenization is the digital representation of a traditional asset using blockchain or distributed ledger technology16. The benefits of tokenization include creating efficiency gains in executing value transfer, facilitating market liquidity, and greater transparency.17 Since 2017, numerous proofs of concept have emerged in bond and equity markets, testing and refining how blockchains are utilized to realize these benefits, while also testing the same, or better, levels of robustness in traditional financial instruments and institutions.

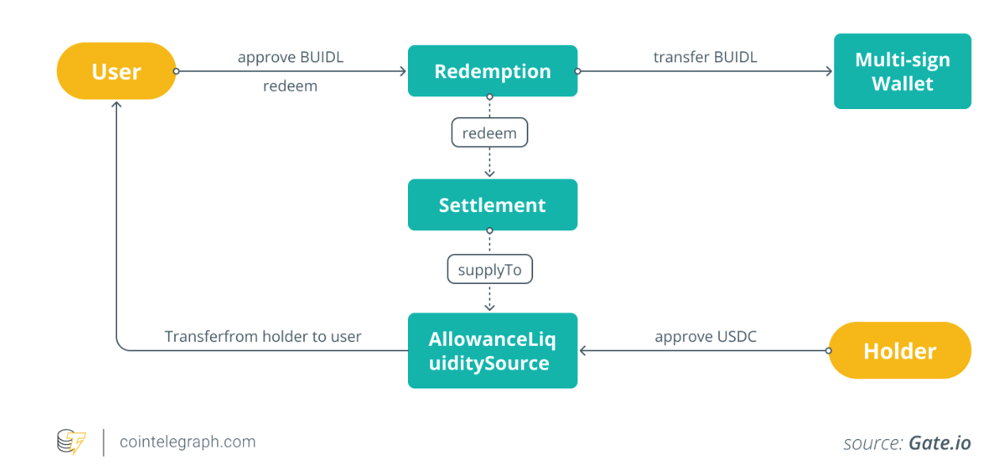

In recent years, blue-chip institutions have moved well beyond experimentation with tokenization use cases to full-scale deployments. For instance, in 2024 and 2025, BlackRock issued and expanded its first tokenized money market fund, the BlackRock USD Institutional Digital Liquidity Fund Token, known as BUIDL.

Figure 3: How BUIDL works18

Traditional asset transfers within money market funds often take days to settle and can offer suboptimal capital efficiency. But with tokenization, trades and settlements are nearly instantaneous, allowing for greater speed of execution and lower administrative costs. In effect, this marries the benefits of traditional financial products (a track record of stability and clear regulation) with those of blockchain-based technology. 18 As of June 2025, this fund has a market capitalization in excess of $2.9 billion19.

J.P. Morgan is another prime example of a traditional player making big bets on tokenization. Kinexys (formerly known as Onyx) is J.P. Morgan’s blockchain-based financial infrastructure platform, which offers a range of products from cross-border digital payments to tokenization of financial assets. J.P. Morgan reports that Kinexys processes more than $2 billion in daily transaction volume20.

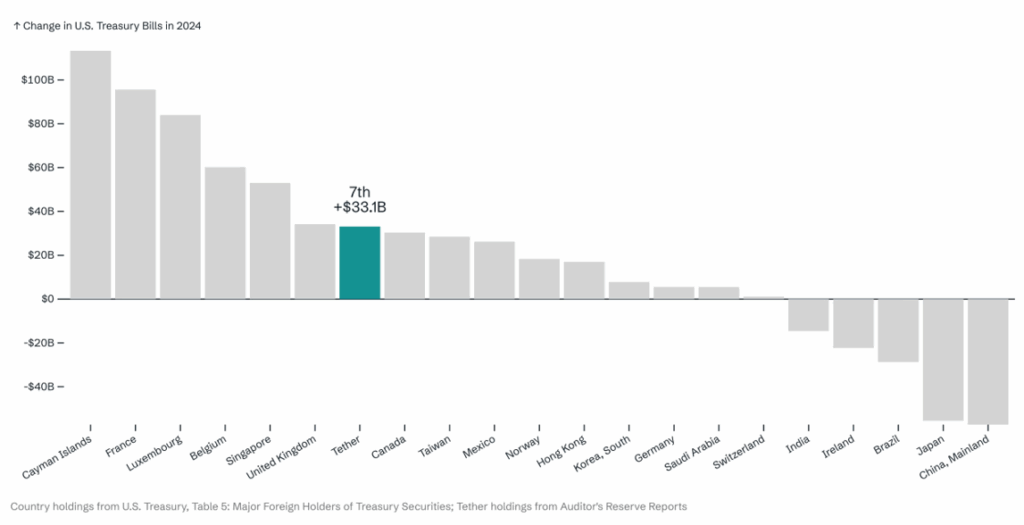

The rise of stablecoins

The standout case in recent months in terms of commercial growth is stablecoins. From $130 billion of stablecoins in circulation in January 2024, the total stablecoin supply as of August 19, 2025 is $276 billion21. To provide a sense for the significance of this growth, Tether, currently the largest stablecoin issuer, reportedly purchased $33 billion in US Treasuries in 2024. This would place Tether as the 7th largest net buyer of U.S. debt when compared with other sovereign nations, just behind the United Kingdom, and ahead of Canada22.

Figure 4: Change in U.S. Treasury Bills in 2024

Furthermore, in June, Circle Internet Group, the company that issues USDC, the 2nd largest stablecoin by circulation, completed its IPO on the NYSE. It opened at $31 per share on June 4, 2025, and as of August 19, 2025, is now trading at $135 per share, valuing the company at $31 billion.

The growing use of stablecoins as an alternative to traditional settlement assets has drawn the attention of policymakers, central banks, and financial authorities worldwide. They are now considering the implications this shift may have on monetary policy and global currency markets as a whole.

U.S. Policy and Regulatory Action

Much has changed in recent months with the transition from the Biden to the Trump administration. Among these changes is a significant shift towards a more permissive stance with respect to the development and adoption of digital assets. Historically, regulation, or the lack thereof, has been an essential factor in how digital assets have evolved. As the ambitions of legislators and regulatory institutions within the U.S. shift, there will likely be wide-reaching implications in terms of where and how the market develops, both within the U.S. and abroad.

The Securities and Exchange Commission

There have been significant changes in leadership at the U.S. Securities and Exchange Commission (SEC) following the transition from the Biden to the Trump administration. With the appointment of Chairman Paul Atkins, replacing former Chairman Gary Gensler, and the appointment of Commissioner Hester Pierce as the leader of the SEC’s ‘Crypto Task Force’, there have already been several changes in the SEC’s proposed remit and enforcement actions. As a small sampling:

- January 23: The SEC rescinded Staff Accounting Bulletin No. 121, an accounting rule that required banks to treat bitcoin and other digital assets as a liability on their balance sheets, which acted as a major deterrent23.

- February 27: The SEC dismissed its civil enforcement action against Coinbase. The case, raised in 2023, that Coinbase violated SEC regulations without proper registration24.

- March 19: The SEC dismissed its 2020 lawsuit against Ripple for conducting a $1.3 billion securities offering in issuing its native digital asset, XRP25.

- June 12: The SEC withdrew a proposal (3b-16) to expand the SEC’s remit by redefining DeFi protocols as securities exchanges26.

Congress

Both the House of Representatives and the Senate are moving quickly this year to advance legislation that establishes legal clarity for the advancement of digital assets. The most recent bill passed, the bipartisan GENUIS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), sets out to establish a regulatory framework for stablecoins, including consumer protection, reserve-quality, and national-security clauses.

In June 2025, the GENUIS Act passed the Senate on a bipartisan basis27, which quickly thereafter, obtained House approval and was signed into law with Presidential approval in July28. This Act allows for a widening of the utilization of stablecoins by market actors within clear federal guardrails once fully implemented.

The Trump Administration

Finally, President Trump himself has heavily advocated for a more permissive stance towards digital assets during his 2024 campaign and has upheld his commitment in the early months of his administration. For instance, in:

- December 2024: President Trump appointed David Sacks, a well-known crypto investor, as the incoming appointee of a newly formed role as the White House A.I. and Crypto Czar. 29

- January 2025: President Trump issued an executive order to establish US leadership in digital financial technology, committing to eliminating regulatory overreach and establishing a Presidential Working Group on Digital Asset Markets, chaired by Sacks.

- March 2025: President Trump announced the establishment of a ‘Strategic Bitcoin Reserve’ and a ‘Digital Asset Stockpile’.30

In addition to his official duties, President Trump and his family’s ventures have further illustrated the new political climate. For instance, then-incoming President Trump issued a personal ‘meme coin’ (a coin described as bearing no intrinsic value) $TRUMP, which established an initial market cap of $9 billion in the early days of its issuance, which has since reduced to $1.7 billion as of August 19, 2025. Furthermore, Donald Trump Junior, Eric Trump, and Barron Trump, alongside four other co-founders, established World Liberty Financial, a new stablecoin issuer that has issued more than $2 billion in supply since its creation in April 2025.31

Conclusion

Over the past 15 years, digital assets have matured from esoteric science projects to a growing, multi‑trillion‑dollar ecosystem increasingly embedded within traditional finance. The United States’ recent policy and regulatory stance may further catalyze commercial adoption of Bitcoin, tokenization, stablecoins, and DeFi. Yet, considerable known and unknown risks, such as volatility, smart‑contract exploits, and governance concentration, necessitate caution for potential investors and policymakers alike.

Disclosure:

THIS COMMENTARY HAS BEEN PREPARED BY CLEARWATER CAPITAL PARTNERS. THE OPINIONS VOICED IN THIS MATERIAL ARE FOR GENERAL INFORMATION ONLY AND ARE NOT INTENDED TO PROVIDE OR BE CONSTRUED AS PROVIDING LEGAL, ACCOUNTING, OR SPECIFIC INVESTMENT ADVICE OR RECOMMENDATIONS FOR ANY INDIVIDUAL. ALL ECONOMIC DATA IS DERIVED FROM PUBLIC SOURCES BELIEVED TO BE RELIABLE. TO DETERMINE WHICH INVESTMENTS MAY BE APPROPRIATE FOR YOU, PLEASE CONSULT WITH US PRIOR TO INVESTING. INVESTING INVOLVES RISK WHICH MAY INCLUDE LOSS OF PRINCIPAL.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities, insurance products, or to adopt any investment strategy. The opinions expressed are as of the date of writing and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by Clearwater Capital Partners to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. Past performance is no guarantee of future results. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. Investment involves risks. International investing involves additional risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. S&P 500 is a registered trademark of Standard & Poor’s Financial Services, a division of S&P Global (“S&P”) DOW JONES, DJ, DJIA and DOW JONES INDUSTRIAL AVERAGE are registered trademarks of Dow Jones Trademark Holdings (“Dow Jones”). FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, WOFE, RBSL, RL, and BR. “FTSE®” “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “Refinitiv”, “Beyond Ratings®”, “WMRTM”, “FRTM” and all other trademarks and service marks used herein are trademarks and/or service marks owned or licensed by the applicable member of LSEG or their respective licensors and are owned, or used under license, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, WOFE, RBSL, RL or BR. The two main risks related to fixed-income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments.

Sources:

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System.

- CoinMarketCap, 17 June 2025. CoinMarketCap https://coinmarketcap.com/.

- Lipton, A. & Levi, S. An Introduction to Smart Contracts and Their Potential and Inherent Limitations. The Harvard Law School Forum on Corporate Governance https://corpgov.law.harvard.edu/2018/05/26/an-introduction-to-smart-contracts-and-their-potential-and-inherent-limitations/ (2018).

- Auer, R., Haslhofer, B., Kitzler, S., Saggese, P. & Victor, F. The Technology of Decentralized Finance (DeFi). (2023).

- Cambridge Centre for Alternative Finance, DeFi 101 | DeFi Navigator. https://ccaf.io/defi/defi-101.

- CCAF, Digital money instruments, 2025. https://ccaf.io/cdmd/dm101/emerging-forms-of-digital-money#stablecoins.

- Algorithmic Stablecoin Definition | CoinMarketCap. CoinMarketCap Academy https://coinmarketcap.com/academy/glossary/algorithmic-stablecoin.

- TerraUSD Price, UST to USD, Research, News & Fundraising | Messari. https://messari.io/project/terrausd.

- Who Broke the Bank of England? – Case – Faculty & Research – Harvard Business School. https://www.hbs.edu/faculty/Pages/item.aspx?num=36754.

- The Fall of Terra: A Timeline of the Meteoric Rise and Crash of UST and LUNA. CoinDesk https://www.coindesk.com/learn/the-fall-of-terra-a-timeline-of-the-meteoric-rise-and-crash-of-ust-and-luna.

- CoinShares Institutional Report – 13F Filings of Bitcoin ETFs Q1 2025. https://coinshares.com/corp/insights/research-data/13f-filings-of-bitcoin-etfs-q1-2025-institutional-report/?utm_source=chatgpt.com.

- iShares Bitcoin Trust ETF | IBIT. BlackRock https://www.blackrock.com/us/individual/products/333011/ishares-bitcoin-trust.

- What is total value locked (TVL) in crypto and why does it matter? Cointelegraph https://cointelegraph.com/explained/what-is-total-value-locked-tvl-in-crypto-and-why-does-it-matter (2022).

- DefiLlama. DefiLlama https://defillama.com/chain/Ethereum.

- Governance | DeFi Navigator. https://ccaf.io/defi/protocol-deep-dive/governance.

- Decentralised financial technologies: Report on financial stability, regulatory and governance implications. Financial Stability Board https://www.fsb.org/2019/06/decentralised-financial-technologies-report-on-financial-stability-regulatory-and-governance-implications/ (2019).

- OECD. OECD (2020), The Tokenisation of Assets and Potential Implications for Financial Markets, OECD Blockchain Policy Series, Www.Oecd.Org/Finance/The-Tokenisation-of-Assets-and-PotentialImplications-for-Financial-Markets.Htm. (OECD, 2020). doi:10.1787/83493d34-en.

- BlackRock’s BUIDL fund explained: Why it matters for crypto and TradFi. Cointelegraph https://cointelegraph.com/explained/blackrocks-buidl-fund-explained-why-it-matters-for-crypto-and-tradfi (2025).

- BlackRock USD Institutional Digital Liquidity Fund Token | BUIDL Price. https://stomarket.com/sto/blackrock-usd-institutional-digital-liquidity-fund-buidl.

- Introducing Kinexys | J.P. Morgan. https://www.jpmorgan.com/insights/payments/payment-trends/introducing-kinexys.

- DefiLlama. DefiLlama https://defillama.com/stablecoins.

- USDT Issuer Tether Ranks Among Top Foreign Buyers of U.S. Treasuries in 2024, Firm Says. CoinDesk https://www.coindesk.com/business/2025/03/20/tether-ranks-among-top-foreign-buyers-of-u-s-treasuries-in-2024-firm-says.

- SEC.gov | Staff Accounting Bulletin No. 121. https://www.sec.gov/rules-regulations/staff-guidance/staff-accounting-bulletins/staff-accounting-bulletin-121.

- SEC.gov | SEC Announces Dismissal of Civil Enforcement Action Against Coinbase. https://www.sec.gov/newsroom/press-releases/2025-47.

- SEC.gov | SEC Charges Ripple and Two Executives with Conducting $1.3 Billion Unregistered Securities Offering. https://www.sec.gov/newsroom/press-releases/2020-338.

- SEC.gov | Supplemental Information and Reopening of Comment Period for Amendments to Exchange Act Rule 3b-16 Regarding the Definition of “Exchange”. https://www.sec.gov/rules-regulations/2025/06/supplemental-information-reopening-comment-period-amendments-exchange-act-rule-3b-16-regarding.

- Sen. Hagerty, B. [R-T. Text – S.394 – 119th Congress (2025-2026): GENIUS Act of 2025. https://www.congress.gov/bill/119th-congress/senate-bill/394/text (2025).

- House, T. W. Fact Sheet: President Donald J. Trump Signs GENIUS Act into Law. The White House https://www.whitehouse.gov/fact-sheets/2025/07/fact-sheet-president-donald-j-trump-signs-genius-act-into-law/ (2025).

- Statement by President-elect Donald J. Trump Announcing the Appointment of David O. Sacks as ‘White House A.I. & Crypto Czar’ | The American Presidency Project. https://www.presidency.ucsb.edu/documents/statement-president-elect-donald-j-trump-announcing-the-appointment-david-o-sacks-white.

- House, T. W. Fact Sheet: President Donald J. Trump Establishes the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile. The White House https://www.whitehouse.gov/fact-sheets/2025/03/fact-sheet-president-donald-j-trump-establishes-the-strategic-bitcoin-reserve-and-u-s-digital-asset-stockpile/ (2025).

- World Liberty Financial USD price today, USD1 to USD live price, marketcap and chart. CoinMarketCap https://coinmarketcap.com/currencies/usd1/.

20250902 – 5

John E. Chapman Chief Executive Officer

John E. Chapman Chief Executive Officer