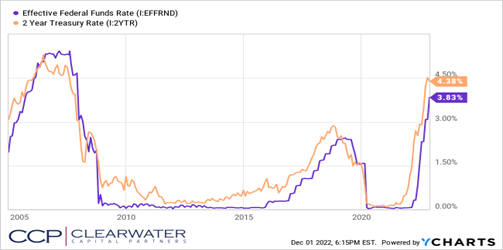

As rates have increased in 2022, short term fixed income yields are the highest they’ve been in nearly 15 years. The Federal Reserve has been aggressively tightening monetary policy to bring down inflation by increasing the Federal Funds Rate. The actions of the Fed and other central banks around the world have resulted in significant volatility in equities and in interest rates.

While volatility is often undesirable, it presents opportunities. As shown below, with the Fed on its tightening course, the 2-year Treasury rate has surged to levels not seen since 2007.

Higher yields are welcome news for investors with excess cash depending on where that cash may be sitting. If the excess cash is sitting in a bank checking or savings account, it is very likely that those interest rates look nothing like the graph above. In fact, the Federal Deposit Insurance Corporation (FDIC) reported that the National Deposit Savings Rate was 0.24% and the 1-year Bank CD came in at an average of 0.90% as of the latest reading in November.

Large banks are typically very slow to increase their savings rates and will only make slight adjustments compared to the Federal Funds Rate. While this can be frustrating, there are still plenty of options generating much higher yields to invest excess cash as detailed below.

Sources: FDIC, BlackRock, State Street. Yields are as of 11/30 and the bond fund yields are expressed as Yield-To-Maturity (YTM).

There is no shortfall of options generating a 4-5% yield, however, there are significant differences between these investment options as it relates to objectives and risk that must be addressed.

- Bank CDs are fixed income investments available at your local bank that pay a set rate of interest over a set maturity. Early withdrawals from a Bank CD may result in fees.

- Brokered CDs are available to be purchased through a brokerage firm (i.e. Charles Schwab). Brokered CDs allow for a wider set of CD options from different banks while keeping the same FDIC insurance as typical Bank CDs. In addition, because Brokered CDs are traded through brokerage firms, there is a secondary market for these instruments meaning that they can be bought and sold. If selling before maturity, there would not be any withdrawal penalties, but they are subject to the market value of the security which can fluctuate.

- Money Market funds are a type of mutual fund that seeks to maintain a net asset value (NAV) of $1.00 per share and invests in very short term and high-quality debt investments. While this is considered a cash equivalent, it’s important to note that these investments are not FDIC insured.

- Individual Treasury bonds are debt securities backed by the full faith and credit of the U.S. government. Treasury bonds can be bought through a broker/custodian (i.e. Charles Schwab).

- ETF bond funds will hold bonds of various issuers, maturities, and credit ratings. These ETF’s will trade on an exchange intraday just like a stock. Because ETFs will typically trade much more frequently than the underlying bonds they own, it’s important to understand the underlying liquidity of the funds when transacting. Like Money Market funds, these are not FDIC insured investments.

Depending on when funds are needed, the purpose of the funds, and the overall risk considerations will determine which investments may be appropriate. For example, cash that is used for living expenses or emergency savings may be best served keeping at the bank in a checking/savings account for its flexibility and FDIC insurance. Once these needs are covered, excess cash can then be evaluated to craft a short-term fixed income strategy. As we have seen in 2022, even “safe” bond investments can carry risks and while we can’t cover all the risks here, it’s important to understand the key risks that are present:

- Interest rate risk: As market interest rates move up, the price of the bond moves down. Duration is a metric used to measure a bond’s sensitivity to moving interest rates and is a very important consideration.

- Reinvestment risk: As bonds pay interest there is a risk of reinvesting those proceeds at lower interest rates

- Inflation risk: Except for inflation adjusted bonds, bonds pay interest in nominal terms. This means that if inflation is higher than the interest rate of the bond, the bond can still have a negative real return.

- Liquidity risk: As mentioned before, individual bonds do not trade very often, so price transparency is not as available as individual stocks. We believe ETFs help with price transparency, but extreme market environments can cause volatility in pricing.

- Credit/Default risk: This is the risk that the issuing entity is unable to pay back the debt. Different debt securities may have higher or lower default risk, but in the context of a safe, short-term strategy this is crucial.

When investing excess cash, it’s these risks that need to be weighed and balanced to craft the appropriate strategy in achieving preservation of capital, income, and liquidity. These strategies are truly unique to each individual circumstance and should be considered as part of the larger wealth strategy.

If you have questions that relate to investing excess cash in a short-term fixed income strategy, please reach out to your Clearwater Capital Advisor.

John E. Chapman

Chief Executive Officer

John E. Chapman

Chief Executive Officer