Last month, the Social Security Trustees issued their annual report, forecasting the financial future of the program for the next 75 years. The program initially provided income to retirees aged 65 or older. Over the decades, it has broadened to include disability insurance, survivor benefits, and Supplemental Security Income (SSI), becoming indispensable to millions. Despite its expansion, the latest projections indicate that Social Security is approaching insolvency, emphasizing the urgent need for reform. This month’s retirement insights will examine the asset reserves, revenue flows, benefits paid, and the workforce supporting the program.

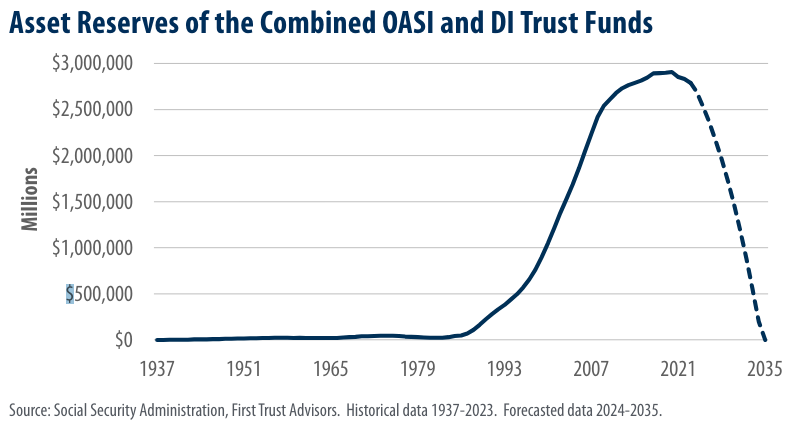

The first chart we review focuses on the asset reserves of Social Security, which includes the Old-Age and Survivors Insurance Trust Fund (OASI) established in 1937, and the Disability Insurance Trust Fund (DI) introduced in 1957. These funds represent the accumulated surpluses of total annual revenues over expenses. Although Social Security began by issuing one-time lump sum payments in January 1937, it was not until January 1940 that regular monthly disbursements started. The asset reserves flourished for decades as revenues consistently exceeded expenditures. Nevertheless, after peaking at $2.9 trillion in 2020, the reserves have been in decline, with the OASI fund projected to be depleted by 2033 and the combined trust funds by 2035.

Next, we turn to Social Security’s revenue and projected benefit payouts. By 2035, the combined trust funds are anticipated to be exhausted, which will result in available funds covering only 83% of promised benefits. The need for legislative action is clear, as the funds cannot legally merge without new laws. Currently, the DI fund is stable, and projected to meet its obligations through at least 2098. However, without the DI fund’s contributions, the OASI fund alone is expected to be exhausted by 2033, with only enough income to fulfill 79% of scheduled benefits. To ensure the program’s solvency over the next 75 years, options include either a 21% reduction in benefits or a 27% increase in payroll taxes, equivalent to a 3.3 percentage point rise.

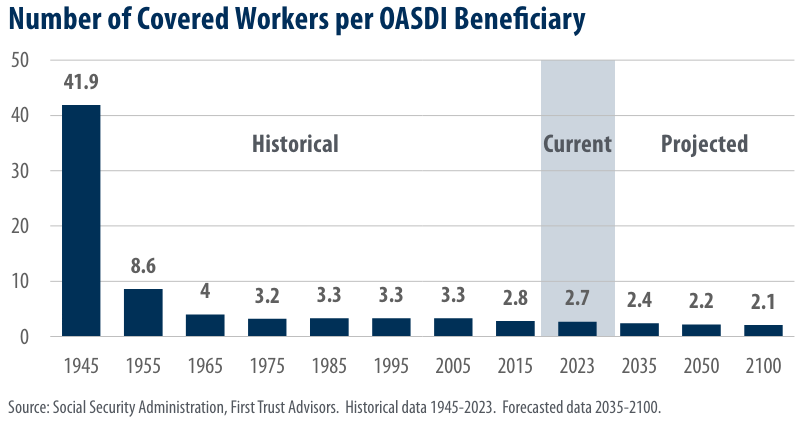

A third key insight comes from examining the worker-to-beneficiary ratio, an essential indicator of the system’s health. The slowing growth rate of workers contributing to the system, versus the rapid increase in beneficiaries, is pushing the program toward insolvency. This ratio has drastically fallen from 41.9 workers per beneficiary in 1945 to just 2.7 in 2023, with projections suggesting a further decline to 2.1 by 2100. Factors like declining birth rates, an aging population, and slower immigration rates contribute to this downward trend.

In conclusion, these troubling trends underline the importance of comprehensive financial planning with your Clearwater Capital advisor. By engaging in lifetime income modeling, you can navigate the uncertainties of future Social Security benefits and ensure financial stability throughout your retirement. Planning today with your team not only prepares you for potential reductions in Social Security benefits but also positions you to take proactive steps to safeguard your long-term financial health.

John E. Chapman

Chief Executive Officer

John E. Chapman

Chief Executive Officer